The total bio-pesticides market was estimated at $ 3.2 billion in 2017. The market is expected to grow at a CAGR of 6.8% from 2017-2023 and is projected to reach $ 6.8 billion by 2023. An increase in population resulted in the rising demand for food. To maintain an optimum balance between food demand and supply, chemical pesticides have been extensively used. The harmful residues of these chemical pesticides have adversely affected the food chain. The use of synthetic pesticides has resulted in the contamination of food, water, and air.

Bio-pesticides have risen as a viable eco-friendly alternative to synthetic or chemical pesticides. They are usually a less toxic substance than traditional synthetic pesticides. The support and encouragement of the USA Environment Protection Authority (EPA) for the use of environmentally friendly pesticides drive the market heavily.

Bio-pesticides are formulated in a manner that they eliminate target pests and related organisms, which can damage vegetables and crops. In terms of types of products, bio-fungicides and bio-insecticides accounted for the largest market share in 2017. The impact of conventional insecticides is less effective due to increasing resistance among pests and insects. Crop and vegetable growers are inclined towards the usage of bio-insecticides, which is cost-effective and has convenient handling properties. The ban on certain chemical insecticides and fungicides provides an edge to the bioinsecticides and biofungicides market. The bio-nematicides segment is expected to grow at the fastest rate due to its increasing usage in oil seed protection.

The quantity of bio-pesticides used in fruits and vegetables is more than any other crop type. Increasing food and vegetable production is one of the major reasons for bio-pesticides consumption globally. Bio-pesticides are extremely effective against microbial infections that damage fruit crops, which result in their increasing acceptance in the agriculture sector, globally. Other significant crop types are grains and oil seeds.

In terms of modes of application, foliar spray was the most popular segment in 2017. Bio-pesticides directly applied to foliage ensures its strong impact on insects, pests, and bugs.

North America accounted for the largest market share in 2017, followed by Europe and Asia-Pacific. The presence of a large number of organic farms, process centres & facilities, as well as vineyards and ranches boosts the usage of bio-pesticides in the region. The ban on certain chemicals and toxic insecticides & pesticides such as 1,3-Dichloropropene and neonicotinoid pesticides (France, Germany, Slovenia, and Italy) fuel the growth in Europe for bio-pesticides market.

Companies are joining hands to develop new and innovative bio-pesticides solutions worldwide. In 2016, BASF signed a collaborative agreement with a start-up company-Plant Advanced Technologies (PAT). Under this agreement, PAT is expected to employ its "Plant Milking" and "Target Binding" technologies to identify probable bio-chemical candidates for novel pesticides. BASF is anticipated to use its proprietary advanced plant platform to screen candidates to experimentally validate their biological effects. Some of the major players that operate in the industry are BASF SE, The DOW Chemical Company, Monsanto Company, Marrone Bio Innovations Inc., Isagro SPA, Valent Biosciences Corporation, Certis Usa L.L.C., W. Neudorff GmbH Kg, Koppert B.V., Bioworks, Inc., and Camson Bio Technologies Limited.

1 Introduction

1.1 Goal & Objective

1.2 Report Coverage

1.3 Supply Side Data Modelling & Methodology

1.4 Demand Side Data Modelling & Methodology

2 Executive Summary

3 Market Outlook

3.1 Introduction

3.2 Current & Future Outlook

3.3 DROC

3.3.1 Drivers

3.3.1.1 Demand Drivers

3.3.1.2 Supply Drivers

3.3.2 Restraints

3.3.3 Opportunities

3.3.4 Challenges

3.4 Market Entry Matrix

3.5 Market Opportunity Analysis

3.6 Market Regulations

3.7 Pricing Mix

3.8 Key Customers

3.9 Value Chain & Ecosystem

4 Demand Market Analysis

4.1 Bio-Pesticides Market, By Source

4.1.1 Bio-Chemicals

4.1.1.1 Plant Extracts

4.1.1.2 Minerals

4.1.1.3 Semiochemicals

4.1.1.4 PGR's

4.1.1.5 Oragnic Acids

4.1.2 Microbials

4.1.1.2.1 Bacteria

4.1.1.2.2 Fungi

4.1.1.2.3 Protozoa

4.1.1.2.4 Virus

4.1.1.2.5 Yeasts Others

4.1.3 Plant-Incorporated-Protectants (PIPs)

5 Bio-Pesticides Market, By Product

5.1 Bioinsecticides

5.1.1 Bacillus Thuringiensis

5.1.2 Verticillium Lecanii

5.1.3 Beauveria Bassiana

5.1.4 Metarhizium Anisopliae

5.2 Biofungicides

5.2.1 Bacillus cereus

5.2.2 Bacillus subtilis

5.2.3 Jingangmycin

5.2.4 Kasugamycin

5.2.5 Polyoxin

5.3 Bionematicides

5.3.1 Pasteuria usgae

5.3.2 Paecilomyces lilacinus

5.3.3 Quillaja saponaria

5.3.4 Others

5.4 Bioherbicides

5.4.1 Chondrostereum purpureum

5.4.2 Phytophthora palmivora

5.4.3 Others

6 Biopesticides Market, By Target Pest

6.1 Introduction

6.2 Caterpillars

6.3 Botrytis spp.

6.4 Sting nematode

6.5 Whitefly

6.6 Morenia orderata

6.7 Codling moth

6.8 Others

6.1.1 Zucchini yellow mosaic virus

6.1.2 Ragwort

6.1.3 Others

7 Biopesticides Market, By Formulation

7.1 Liquid Formulation

7.2 Powder Formulation

8 Biopesticides Market, By Crop Type

8.1 Crop-Based

8.1.1 Grains & Oilseeds

8.1.2 Fruits & Vegetables

8.1.3 Others

8.2 Non-Crop-Based

8.2.1 Turf & Ornamental Grass

8.2.2 Others

9 Biopesticides Market, By Mode of Application

9.1 Seed Treatment

9.2 Soil Treatment

9.3 Foliar Spray

9.4 Post-Harvest

10 Biopesticides Market Analysis, By Region

10.1 North America

10.1.1 U.S.

10.1.2 Canada

10.1.3 Mexico

10.2 Europe

10.2.1 Germany

10.2.2 Italy

10.2.3 France

10.2.4 UK

10.2.5 Rest of Europe

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 Australia

10.3.5 Rest of APAC

10.4 Middle East & Africa

10.4.1 Saudi Arabia

10.4.2 UAE

10.4.3 Rest Of MEA

10.5 South America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South America

11 Supply Market Analysis

11.1 Strategic Benchmarking

11.2 Market Share Analysis

11.3 Key Players

11.3.1 BASF SE

11.3.2 The DOW Chemical Company

11.3.3 Monsanto Company

11.3.4 Marrone Bio Innovations Inc.

11.3.5 Isagro SPA

11.3.6 Valent Biosciences Corporation

11.3.7 Certis Usa L.L.C.

11.3.8 W. Neudorff GmbH Kg

11.3.9 Koppert B.V.

11.3.10 Bioworks, Inc.

11.3.11 Camson Bio Technologies Limited

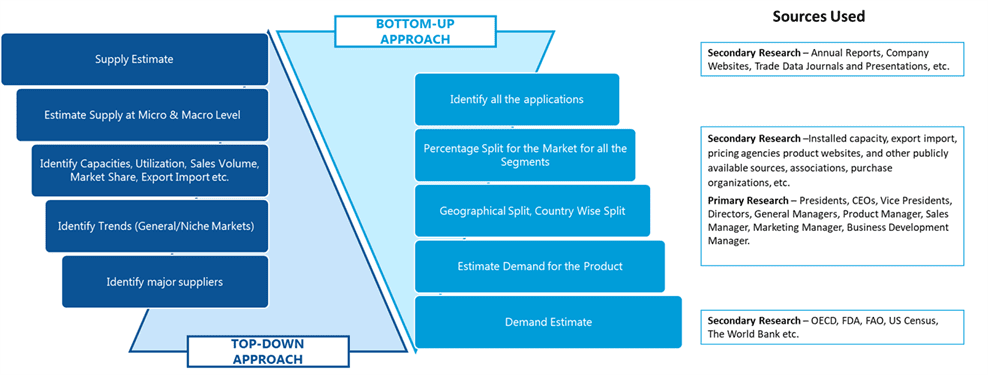

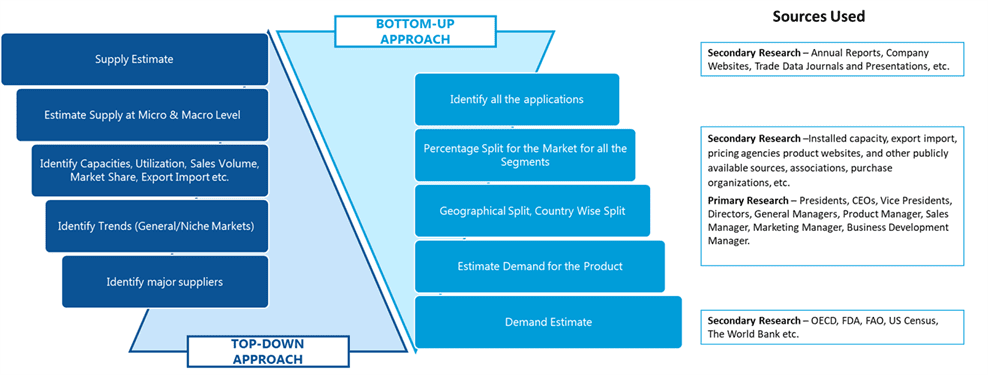

SDMR employs a three way data triangulation approach to arrive at market estimates. We use primary research, secondary research and data triangulation by top down and bottom up approach

Secondary Research:

Our research methodology involves in-depth desk research using various secondary sources. Data is gathered from association/government publications/databases, company websites, press releases, annual reports/presentations/sec filings, technical papers, journals, research papers, magazines, conferences, tradeshows, and blogs.

Key Data Points through secondary research-

Macro-economic data points

Import Export data

Identification of major market trends across various applications

Primary understanding of the industry for both the regions

Competitors analysis for the production capacities, key production sites, competitive landscape

Key customers

Production Capacity

Pricing Scenario

Cost Margin Analysis

Key Data Points through primary research-

Major factors driving the market and its end application markets

Comparative analysis and customer analysis

Regional presence

Collaborations or tie-ups

Annual Production, and sales

Profit Margins

Average Selling Price

Data Triangulation:

Data triangulation is done using top down and bottom approaches. However, to develop accurate market sizing estimations, both the methodologies are used to accurately arrive at the market size. Insert Image