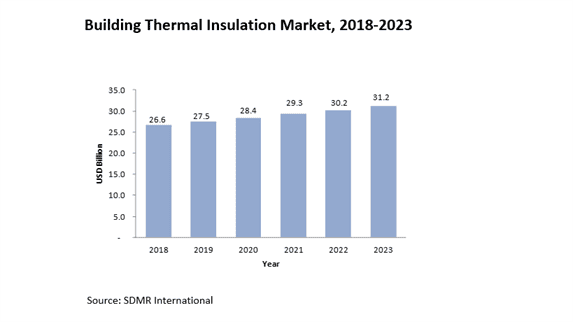

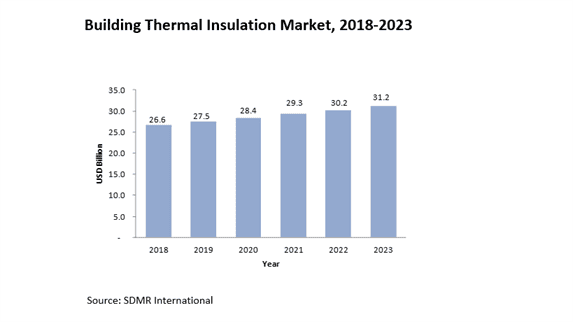

The building thermal insulation market is estimated to account for USD 25.8 billion in 2017, and is projected to grow at a CAGR of 3.25% to reach USD 31.2 billion by 2023. Stringent regulations pertaining to reduction of GHG emissions in North America and Europe are primarily driving the building thermal insulation market. The opportunities for players in the BTI market lies in exploring the untapped market in the emerging economies and launching better energy efficient products.

In the building thermal insulation market, with respect to materials, plastic foams is the leading segment. Its demand is prominent in the Asia-Pacific market along with significant consumption in the European countries. The superior properties of plastic foams, such as low thermal conductivity, high strength, and lifespan, and versatility have been driving its demand over the years. Among the varieties of plastic foams, Expanded polystyrene (EPS) is expected to be the fastest growing segment with a CAGR of 4.0-4.5% for the next five years until 2023. Low thermal conductivity (high R-value) of EPS’ enables the manufacturers to use it in lower quantities to make products of similar thermal resistance in comparison to other insulation materials. In addition, EPS’ durability and lightness is driving its demand in the European and the North American market.

In 2017, Wool insulation accounts for the second largest share in the BTI market by materials. It is estimated to account for about 40.0% of the total building thermal insulation market in terms of value. Wool insulation products such as blankets & sheets are the widely used as they possess temperature sustaining capacity up to 4100 C and thickness varying from 25 to 150 mm. In the coming years, glass wool is anticipated to be the leading material in this segment. Glass wool’s demand is high due to its increasing usage in masonry cavity walls, flat roofs, and suspended floor insulations owing to low inflammability.

In 2017, Wall insulation accounted for the highest share among roof and floor applications, and is expected to continue to dominate during the forecast period. The walls have the large surface area and maximum dissipation of energy takes place through walls in a building, thus driving the demand for wall insulation. Roofs account for the second largest share as it is the prominent source of heat penetration from direct sunrays and proper insulation is required to maintain optimal temperatures.

Residential building segment is estimated to account for about 55.0% of the total building thermal insulation market in 2017. However, the non-residential segment is anticipated to account for the rest 45.0% of the total BTI market value. The presence of strict building codes, accompanied by the growing demand for housing sector especially in the US, the UK, and Germany drive the demand for building thermal insulation in residential buildings. The non-residential segment is expected to witness high growth than residential segment during the forecast period. Increasing activities in the industrial and the manufacturing segment in the U.S. is expected to drive the demand for building thermal insulation in the non-residential segment in North America. The rising energy cost drives the demand for building thermal insulation in both residential and non-residential segment.

In 2017, North America accounted for the largest share in the building thermal insulation market followed Europe and then Asia-Pacific. The building thermal insulation market in North America and Europe is driven by the stringent building codes, and the growth of housing sector primarily in U.S., the U.K. and Germany. An initiative like Weatherization Assistance Program (WAP) to focus adoption of thermal laggings in low income households at a large scale has boosted the North American building thermal insulation market.

The insulation market in Europe is mostly dependent upon retrofit and renovation activities leading to re-insulation of old buildings. In the Western European region, after Germany, Poland is the second largest market for building thermal insulation products. Asia-Pacific is anticipated to be the fastest growing market for building thermal insulation products during the forecast period i.e. from 2018-2013. Increasing construction spending in China, India, and Japan to improve infrastructure in addition to energy conservation initiatives is expected to drive the BTI market in the APAC region over the next five years.

The building thermal insulation market is highly fragmented and competitive in nature with the presence of global, regional, and local players. Joint ventures, mergers, collaborations and partnerships, and new product launch are the most prominent strategies practiced in this market to strengthen the market position. For instance, Rockwool International announced its capacity expansion plans in December 2017, wherein, the company would be acquiring land in Sweden, Romania, and U.S. to establish three new production facilities. The key players operating in this industry are BASE SE, Kingspan Group Plc, Owens Corning, Saint-Gobain S.A., Rockwool International, Johns Manville Corporation, Paroc Group, and Knauf Insulation among others.

1. Introduction

1.1. Goal & Objective

1.2. Report Coverage

1.3. Supply Side Data Modelling & Methodology

1.4. Demand Side Data Modelling & Methodology

2. Executive Summary

3. Market Outlook

3.1. Introduction

3.2. Current & Future Outlook

3.3. DROC

3.3.1. Drivers

3.3.1.1. Rising awareness and the need for energy efficient structures

3.3.1.2. Adherence to Stringent Building Energy Codes

3.3.1.3. Strict regulations pertaining to reduction of GHG emissions

3.3.1.4. Development of Green Buildings

3.3.2. Restraints

3.3.2.1. Price volatility of the insulation materials

3.3.2.2. Stagnant growth of Construction Industry in Europe

3.3.3. Opportunities

3.3.3.1. Untapped market in the emerging economies

3.3.4. Challenges

3.3.4.1. Lack of Awareness

3.4. Market Entry Matrix

3.5. Market Opportunity Analysis

3.6. Market Regulations

3.6.1. Energy Efficiency Codes for Building for Major countries

3.7. Cost Structure Analysis

3.8. Pricing Analysis

3.8.1. North America

3.8.2. Europe

3.8.3. Asia-Pacific

3.8.4. Middle East & Africa

3.9. Key Customers List

3.10. Value Chain & Ecosystem

3.10.1. Raw Material Analysis

3.10.2. Building Insulation Materials

3.10.3. Building Insulation Materials Product Forms

3.10.4. Distribution Network

3.10.5. End-Users

3.11. Macroeconomic Indicators

3.11.1. GDP for Major Countries

3.11.2. Construction Industry Analysis

4. Demand Market Analysis

4.1. Building Thermal Insulation Market, By Material

4.2. Plastic Foam

4.2.1. Market Size & Forecasts, 2018-2025

4.2.2. Polystyrene Foam

4.2.2.1. XPS Foam

4.2.2.2. EPS Foam

4.2.3. Polyurethane (PUR) & Polyisocyanurate (PIR) Foam

4.2.4. Others

4.2.4.1. Elastomeric Foam

4.2.4.2. Phenolic Foam

4.2.4.3. Others

4.3. Stone Wool

4.3.1. Market Size & Forecasts, 2018-2025

4.4. Glass Wool

4.4.1. Market Size & Forecasts, 2018-2025

4.5. Others

4.5.1. Market Size & Forecasts, 2018-2025

4.5.2. Aerogel

4.5.3. Cellulose

4.5.4. Others

5. Building Thermal Insulation Market, By Building Type

5.1. Introduction

5.2. Residential

5.2.1. Market Size & Forecasts, 2018-2025

5.3. Industrial

5.3.1. Market Size & Forecasts, 2018-2025

5.4. Commercial

5.4.1. Market Size & Forecasts, 2018-2025

5.5. Others

5.5.1. Market Size & Forecasts, 2018-2025

6. Building Thermal Insulation Market, by Application

6.1. Introduction

6.2. Wall Insulation

6.2.1. Market Size & Forecasts, 2018-2025

6.2.2. Internal Wall Insulation

6.2.3. External Wall Insulation

6.2.4. Cavity Wall Insulation

6.3. Roof Insulation

6.3.1. Market Size & Forecasts, 2018-2025

6.3.2. Flat Roof Insulation

6.3.3. Pitch Roof Insulation

6.4. Floor Insulation

6.4.1. Market Size & Forecasts, 2018-2025

7. Building Thermal Insulation Market Analysis, By Region

7.1. North America

7.1.1. North America Market Size, By Country 2018-2025

7.1.2. North America Market Size, By Material 2018-2025

7.1.3. North America Market Size, By Building Type 2018-2025

7.1.4. North America Market Size, By Application 2018-2025

7.1.4.1. U.S.

7.1.4.1.1. U.S. Market Size, By Material 2018-2025

7.1.4.1.2. U.S. Market Size, By Building Type 2018-2025

7.1.4.1.3. U.S. Market Size, By Application 2018-2025

7.1.4.2. Canada

7.1.4.2.1. Canada Market Size, By Material 2018-2025

7.1.4.2.2. Canada Market Size, By Building Type 2018-2025

7.1.4.2.3. Canada Market Size, By Application 2018-2025

7.1.4.3. Mexico

7.1.4.3.1. Mexico Market Size, By Material 2018-2025

7.1.4.3.2. Mexico Market Size, By Building Type 2018-2025

7.1.4.3.3. Mexico Market Size, By Application 2018-2025

7.2. Europe

7.2.1. Europe Market Size, By Country 2018-2025

7.2.2. Europe Market Size, By Material 2018-2025

7.2.3. Europe Market Size, By Building Type 2018-2025

7.2.4. Europe Market Size, By Application 2018-2025

7.2.4.1. Germany

7.2.4.1.1. Germany Market Size, By Material 2018-2025

7.2.4.1.2. Germany Market Size, By Building Type 2018-2025

7.2.4.1.3. Germany Market Size, By Application 2018-2025

7.2.4.2. Italy

7.2.4.2.1. Italy Market Size, By Material 2018-2025

7.2.4.2.2. Italy Market Size, By Building Type 2018-2025

7.2.4.2.3. Italy Market Size, By Application 2018-2025

7.2.4.3. U.K.

7.2.4.3.1. U.K. Market Size, By Material 2018-2025

7.2.4.3.2. U.K. Market Size, By Building Type 2018-2025

7.2.4.3.3. U.K. Market Size, By Application 2018-2025

7.2.4.4. France

7.2.4.4.1. France Market Size, By Material 2018-2025

7.2.4.4.2. France Market Size, By Building Type 2018-2025

7.2.4.4.3. France Market Size, By Application 2018-2025

7.2.4.5. Spain

7.2.4.5.1. Spain Market Size, By Material 2018-2025

7.2.4.5.2. Spain Market Size, By Building Type 2018-2025

7.2.4.5.3. Spain Market Size, By Application 2018-2025

7.2.4.6. Russia

7.2.4.6.1. Russia Market Size, By Material 2018-2025

7.2.4.6.2. Russia Market Size, By Building Type 2018-2025

7.2.4.6.3. Russia Market Size, By Application 2018-2025

7.2.4.7. Poland

7.2.4.7.1. Poland Market Size, By Material 2018-2025

7.2.4.7.2. Poland Market Size, By Building Type 2018-2025

7.2.4.7.3. Poland Market Size, By Application 2018-2025

7.2.4.8. Rest of Europe

7.2.4.8.1. Rest of Europe Market Size, By Material 2018-2025

7.2.4.8.2. Rest of Europe Market Size, By Building Type 2018-2025

7.2.4.8.3. Rest of Europe Market Size, By Application 2018-2025

7.3. Asia-Pacific

7.3.1. Asia-Pacific Market Size, By Country 2018-2025

7.3.2. Asia-Pacific Market Size, By Material 2018-2025

7.3.3. Asia-Pacific Market Size, By Building Type 2018-2025

7.3.4. Asia-Pacific Market Size, By Application 2018-2025

7.3.4.1. China

7.3.4.1.1. China Market Size, By Material 2018-2025

7.3.4.1.2. China Market Size, By Building Type 2018-2025

7.3.4.1.3. China Market Size, By Application 2018-2025

7.3.4.2. Japan

7.3.4.2.1. Japan Market Size, By Material 2018-2025

7.3.4.2.2. Japan Market Size, By Building Type 2018-2025

7.3.4.2.3. Japan Market Size, By Application 2018-2025

7.3.4.3. India

7.3.4.3.1. India Market Size, By Material 2018-2025

7.3.4.3.2. India Market Size, By Building Type 2018-2025

7.3.4.3.3. India Market Size, By Application 2018-2025

7.3.4.4. South Korea

7.3.4.4.1. South Korea Market Size, By Material 2018-2025

7.3.4.4.2. South Korea Market Size, By Building Type 2018-2025

7.3.4.4.3. South Korea Market Size, By Application 2018-2025

7.3.4.5. Taiwan

7.3.4.5.1. Taiwan Market Size, By Material 2018-2025

7.3.4.5.2. Taiwan Market Size, By Building Type 2018-2025

7.3.4.5.3. Taiwan Market Size, By Application 2018-2025

7.3.4.6. Thailand

7.3.4.6.1. Thailand Market Size, By Material 2018-2025

7.3.4.6.2. Thailand Market Size, By Building Type 2018-2025

7.3.4.6.3. Thailand Market Size, By Application 2018-2025

7.3.4.7. Malaysia

7.3.4.7.1. Malaysia Market Size, By Material 2018-2025

7.3.4.7.2. Malaysia Market Size, By Building Type 2018-2025

7.3.4.7.3. Malaysia Market Size, By Application 2018-2025

7.3.4.8. Indonesia

7.3.4.8.1. Indonesia Market Size, By Material 2018-2025

7.3.4.8.2. Indonesia Market Size, By Building Type 2018-2025

7.3.4.8.3. Indonesia Market Size, By Application 2018-2025

7.3.4.9. Australia

7.3.4.9.1. Australia Market Size, By Material 2018-2025

7.3.4.9.2. Australia Market Size, By Building Type 2018-2025

7.3.4.9.3. Australia Market Size, By Application 2018-2025

7.3.4.10. Rest of Asia-Pacific

7.3.4.10.1. Rest of Asia-Pacific Market Size, By Material 2018-2025

7.3.4.10.2. Rest of Asia-Pacific Market Size, By Building Type 2018-2025

7.3.4.10.3. Rest of Asia-Pacific Market Size, By Application 2018-2025

7.3.4.10.4. Rest of Asia-Pacific Market Size, By End-Use Industry 2018-2025

7.4. Middle East & Africa

7.4.1. Middle East & Africa Market Size, By Country 2018-2025

7.4.2. Middle East & Africa Market Size, By Material 2018-2025

7.4.3. Middle East & Africa Market Size, By Building Type 2018-2025

7.4.4. Middle East & Africa Market Size, By Application 2018-2025

7.4.4.1. Saudi Arabia

7.4.4.1.1. Saudi Arabia Market Size, By Material 2018-2025

7.4.4.1.2. Saudi Arabia Market Size, By Building Type 2018-2025

7.4.4.1.3. Saudi Arabia Market Size, By Application 2018-2025

7.4.4.2. UAE

7.4.4.2.1. UAE Market Size, By Material 2018-2025

7.4.4.2.2. UAE Market Size, By Building Type 2018-2025

7.4.4.2.3. UAE Market Size, By Application 2018-2025

7.4.4.3. Turkey

7.4.4.3.1. Turkey Market Size, By Material 2018-2025

7.4.4.3.2. Turkey Market Size, By Building Type 2018-2025

7.4.4.3.3. Turkey Market Size, By Application 2018-2025

7.4.4.4. Qatar

7.4.4.4.1. Qatar Market Size, By Material 2018-2025

7.4.4.4.2. Qatar Market Size, By Building Type 2018-2025

7.4.4.4.3. Qatar Market Size, By Application 2018-2025

7.4.4.5. South Africa

7.4.4.5.1. South Africa Market Size, By Material 2018-2025

7.4.4.5.2. South Africa Market Size, By Building Type 2018-2025

7.4.4.5.3. South Africa Market Size, By Application 2018-2025

7.4.4.6. Rest Of Middle East & Africa

7.4.4.6.1. Rest Of Middle East & Africa Market Size, By Material 2018-2025

7.4.4.6.2. Rest Of Middle East & Africa Market Size, By Building Type 2018-2025

7.4.4.6.3. Rest Of Middle East & Africa Market Size, By Application 2018-2025

7.4.4.6.4. Rest Of Middle East & Africa Market Size, By End-Use Industry 2018-2025

7.5. South America

7.5.1. South America Market Size, By Country 2018-2025

7.5.2. South America Market Size, By Material 2018-2025

7.5.3. South America Market Size, By Building Type 2018-2025

7.5.4. South America Market Size, By Application 2018-2025

7.5.5. South America Market Size, By End-Use Industry 2018-2025

7.5.5.1. Brazil

7.5.5.1.1. Brazil Market Size, By Material 2018-2025

7.5.5.1.2. Brazil Market Size, By Building Type 2018-2025

7.5.5.1.3. Brazil Market Size, By Application 2018-2025

7.5.5.1.4. Brazil Market Size, By End-Use Industry 2018-2025

7.5.5.2. Argentina

7.5.5.2.1. Argentina Market Size, By Material 2018-2025

7.5.5.2.2. Argentina Market Size, By Building Type 2018-2025

7.5.5.2.3. Argentina Market Size, By Application 2018-2025

7.5.5.2.4. Argentina Market Size, By End-Use Industry 2018-2025

7.5.5.3. Rest of South America

7.5.5.3.1. Rest of South America Market Size, By Material 2018-2025

7.5.5.3.2. Rest of South America Market Size, By Building Type 2018-2025

7.5.5.3.3.

7.5.5.3.4. Rest of South America Market Size, By Application 2018-2025

7.5.5.3.5. Rest of South America Market Size, By End-Use Industry 2018-2025

8. Supply Market Analysis

8.1. Strategic Benchmarking

8.2. Market Share Analysis

8.3. Key Players (Company Snapshot, Product Portfolio, Financials, and Strategic Analysis)

8.3.1. BASF SE

8.3.2. Kingspan Group PLC

8.3.3. Owens Corning

8.3.4. Saint-Gobain S.A.

8.3.5. Rockwool International A/S

8.3.6. Johns Manville Corporation

8.3.7. Gaf Materials Corporation

8.3.8. Paroc Group Oy

8.3.9. Knauf Insulation, Inc

8.3.10. Beijing New Building Material (Group) Co., Ltd.

8.3.11. CertainTeed Corporation

8.3.12. Dow Building Solutions

8.3.13. Atlas Roofing Corporation

8.3.14. Huntsman Corporation

8.3.15. KCC Corporation

8.3.16. Cabot Corporation

8.3.17. Aspen Aerogels & Others

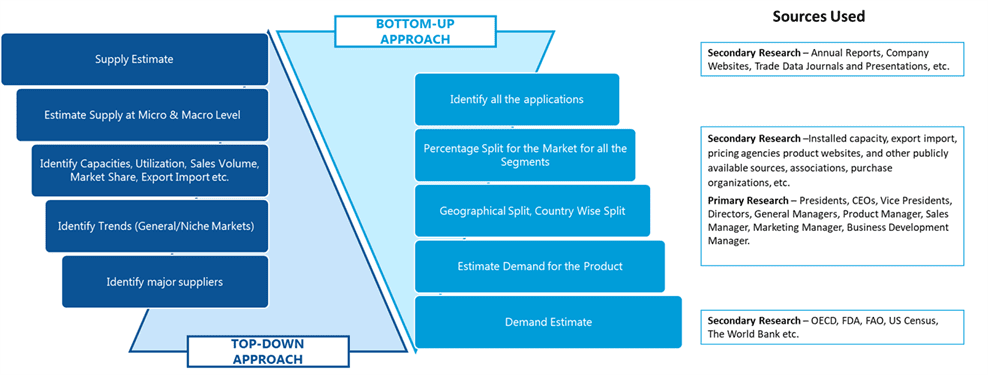

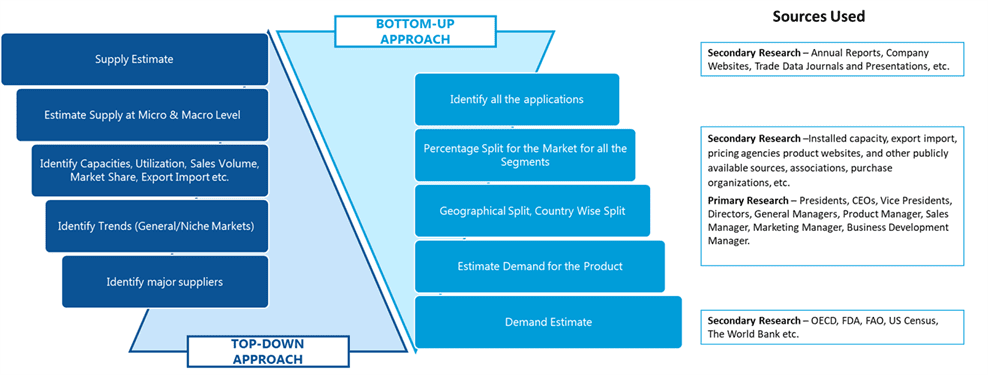

SDMR employs a three way data triangulation approach to arrive at market estimates. We use primary research, secondary research and data triangulation by top down and bottom up approach

Secondary Research:

Our research methodology involves in-depth desk research using various secondary sources. Data is gathered from association/government publications/databases, company websites, press releases, annual reports/presentations/sec filings, technical papers, journals, research papers, magazines, conferences, tradeshows, and blogs.

Key Data Points through secondary research-

Macro-economic data points

Import Export data

Identification of major market trends across various applications

Primary understanding of the industry for both the regions

Competitors analysis for the production capacities, key production sites, competitive landscape

Key customers

Production Capacity

Pricing Scenario

Cost Margin Analysis

Key Data Points through primary research-

Major factors driving the market and its end application markets

Comparative analysis and customer analysis

Regional presence

Collaborations or tie-ups

Annual Production, and sales

Profit Margins

Average Selling Price

Data Triangulation:

Data triangulation is done using top down and bottom approaches. However, to develop accurate market sizing estimations, both the methodologies are used to accurately arrive at the market size. Insert Image