1. Market participants of carriers & powders used in Cosmetics:

1.1.1. Producers (active, potential producers)

1.1.2. End users

1.1.3. Raw material suppliers

1.1.4. Major traders

1.2. Chemicals

1.2.1. Silicone powders & copolymers

1.2.2. Talc

1.2.3. Texturizers

1.2.4. Modified starch

1.2.5. Kaolin

1.2.6. Others

1.3. Market analysis

1.3.1. Capacity

1.3.2. Production

1.3.3. Consumption trends and forecast

1.3.4. Value chain analysis

1.3.5. Price analysis

1.4. Regions / countries

1.4.1. North America

1.4.2. Western Europe

1.4.3. Asia pacific excluding China

1.4.4. China

How this report will add value to your organisation

This report provides the in-depth analysis of the complete value chain from the raw material suppliers to the end users. We have critically analysed following parameters and their impact in the industry:

1. Improvement in top line and bottom line growth

Analysis trend & forecasts by end use markets will help you to understand how the growth in consumption is expected in next 5 years and what will be the key factors that will support the growth. This will help to make a clear plan for the top line growth. Price analytics will also play a crucial role in making a plan for top line growth.

Raw material and other input factors analysis will help to plan effectively for the bottom line.

2. Competitive intelligence

In a competitive marketplace, up-to-date information can make the difference between keeping pace, getting ahead, or being left behind. A smart intelligence operation can serve as an early-warning system for disruptive changes in the competitive landscape, whether that change is a rival's new product or pricing strategy or the entrance of an unexpected player into your market.

We also provide you with information that allows you to anticipate what your competitors are planning next. For example, you might gain information on a new product they are getting ready to launch or new services they will add to the business. Hiring us to handle this information collection saves you time and energy, allowing you to focus on your own business while still gaining the necessary knowledge to keep track of competitors.

3. Identification of prospective customers and their satisfaction level with the current supplier:

We have provided the long list of customers and analysed them critically, based on various parameters such as consumption, market type, sustainable business etc. this will help your organisation to develop relations with the consumers. Also, we have identified the factors in which the others customer will switch to you.

1. Report Coverage

1.1. Market participants of carriers & powders used in Cosmetics:

1.1.1. Producers (active, potential producers)

1.1.2. End users

1.1.3. Raw material suppliers

1.1.4. Major traders

1.2. Chemicals

1.2.1. Silicone powders & copolymers

1.2.2. Talc

1.2.3. Texturizers

1.2.4. Modified starch

1.2.5. Kaolin

1.2.6. Others

1.3. Market analysis

1.3.1. Capacity

1.3.2. Production

1.3.3. Consumption trends and forecast

1.3.4. Value chain analysis

1.3.5. Price analysis

1.4. Regions / countries

1.4.1. North America

1.4.2. Western Europe

1.4.3. Asia pacific excluding China

1.4.4. China

2. Brief Introduction of cosmetic chemicals industry

2.1. Overview

2.2. Product Identification

2.3. Brief overview of global cosmetic chemicals industry by following categories:

2.3.1. Emollients, film formers and moisturizers

2.3.2. Surfactants

2.3.3. Thickening agents

2.3.4. Colorants and pearlescent pigments

2.3.5. Preservatives

2.3.6. Carriers and Powders

2.3.7. Hair Conditioning Polymers

2.3.8. Hair Setting Resins

2.3.9. Antiperspirants and Deodorants

2.3.10. Sunscreen Chemicals

2.3.11. Antidandruff Agents

2.4. Value chain analysis

2.5. Porter five forces analysis of cosmetic chemicals market

2.6. Burning issues in the market such as regulations

2.7. Market dynamics

2.8. Raw material analysis

2.9. Policy and regulations

3. Global Market Analysis

3.1. Current market analysis for the year 2016

3.1.1. Silicone powders & copolymers

3.1.2. Talc

3.1.3. Texturizers

3.1.4. Modified starch

3.1.5. Kaolin

3.1.6. Others

3.2. Forecast from 2017 to 2022

3.2.1. Silicone powders & copolymers

3.2.2. Talc

3.2.3. Texturizers

3.2.4. Modified starch

3.2.5. Kaolin

3.2.6. Others

3.2.7. Key growth drivers

3.2.8. Key challenges

4. North American Market Analysis

4.1. Current market analysis for the year 2016

4.1.1. Silicone powders & copolymers

4.1.2. Talc

4.1.3. Texturizers

4.1.4. Modified starch

4.1.5. Kaolin

4.1.6. Others

4.2. Forecast from 2017 to 2022

4.2.1. Silicone powders & copolymers

4.2.2. Talc

4.2.3. Texturizers

4.2.4. Modified starch

4.2.5. Kaolin

4.2.6. Others

4.2.7. Key growth drivers

4.2.8. Key challenges

5. Western Europe Market Analysis

5.1. Current market analysis for the year 2016

5.1.1. Silicone powders & copolymers

5.1.2. Talc

5.1.3. Texturizers

5.1.4. Modified starch

5.1.5. Kaolin

5.1.6. Others

5.2. Forecast from 2017 to 2022

5.2.1. Silicone powders & copolymers

5.2.2. Talc

5.2.3. Texturizers

5.2.4. Modified starch

5.2.5. Kaolin

5.2.6. Others

5.2.7. Key growth drivers

5.2.8. Key challenges

6. China Market Analysis

6.1. Current market analysis for the year 2016

6.1.1. Silicone powders & copolymers

6.1.2. Talc

6.1.3. Texturizers

6.1.4. Modified starch

6.1.5. Kaolin

6.1.6. Others

6.2. Forecast from 2017 to 2022

6.2.1. Silicone powders & copolymers

6.2.2. Talc

6.2.3. Texturizers

6.2.4. Modified starch

6.2.5. Kaolin

6.2.6. Others

6.2.7. Key growth drivers

6.2.8. Key challenges

7. Asia Pacific (excluding China) Market Analysis

7.1. Current market analysis for the year 2016

7.1.1. Silicone powders & copolymers

7.1.2. Talc

7.1.3. Texturizers

7.1.4. Modified starch

7.1.5. Kaolin

7.1.6. Others

7.2. Forecast from 2017 to 2022

7.2.1. Silicone powders & copolymers

7.2.2. Talc

7.2.3. Texturizers

7.2.4. Modified starch

7.2.5. Kaolin

7.2.6. Others

7.2.7. Key growth drivers

7.2.8. Key challenges

8. Historical & forecast price analysis for the following regions or countries

8.1. North America

8.2. Western Europe

8.3. Asia pacific excluding China

8.4. China

9. Analysis of key manufacturers of for carriers & powders used in Cosmetics *

9.1. Company 1

9.1.1. Company introduction

9.1.2. SWOT analysis in terms of for carriers & powders used in Cosmetics

9.1.3. Financials*

9.1.4. Employee and R&D details**

9.1.5. Products offerings

9.1.5.1. Carriers & powders used in Cosmetics

9.1.5.2. Other products

9.1.6. Plant locations

9.1.6.1. Details of for carriers & powders used in Cosmetics plant

9.1.7. Installed capacity of thickening & gelling agents used in Cosmetics

9.1.7.1. Capacity expansion plans

9.1.7.2. Capacity shares of carriers & powders used in Cosmetics

9.1.8. Strategic imperatives

9.2. Same parameters as above will be repeated for the following companies across:

9.2.1. North America

9.2.1.1. BASF

9.2.1.2. Imerys

9.2.1.3. IMI Fabi

9.2.1.4. Luzenac America

9.2.1.5. Mineral Technologies

9.2.1.6. R. T. Vanderbilt

9.2.2. Western Europe

9.2.2.1. Akzo Nobel

9.2.2.2. Amberger Kaolinwerke Eduard Kick GmbH

9.2.2.3. Arkema

9.2.2.4. Bluestar Silicones

9.2.2.5. Chemopharma

9.2.2.6. Dow Corning

9.2.2.7. Goonvean Limited

9.2.2.8. Imerys

9.2.2.9. IMI Fabi

9.2.2.10. Luzenac Europe

9.2.2.11. Momentive Performance Materials

9.2.2.12. Wacker Chemie AG

9.2.3. Asia Pacific

9.2.3.1. AGC

9.2.3.2. Asada Milling

9.2.3.3. Fuji Talc Industrial

9.2.3.4. Hayashi Kasei

9.2.3.5. Hojun Yoko Co., Ltd.

9.2.3.6. Kuninime Industries Co., Ltd.

9.2.3.7. Matsumura Sangyo

9.2.3.8. Morishita Bengara Kogyo Co., Ltd.

9.2.3.9. Nikki Catalyst

9.2.3.10. Suzuki Yushi

9.2.3.11. Takehara Chemical

9.2.3.12. Titan Kogyo

9.2.3.13. Topy Industries

9.2.3.14. Yamaguchi Mica

10. Appendix

10.1. Research Methodology

10.2. Methodology/Research Approach

10.3. Research Programs/Design

10.4. Market Size Estimation

10.5. Market Breakdown and Data Triangulation Data Source

10.5.1. Secondary Sources

10.5.2. Primary Sources

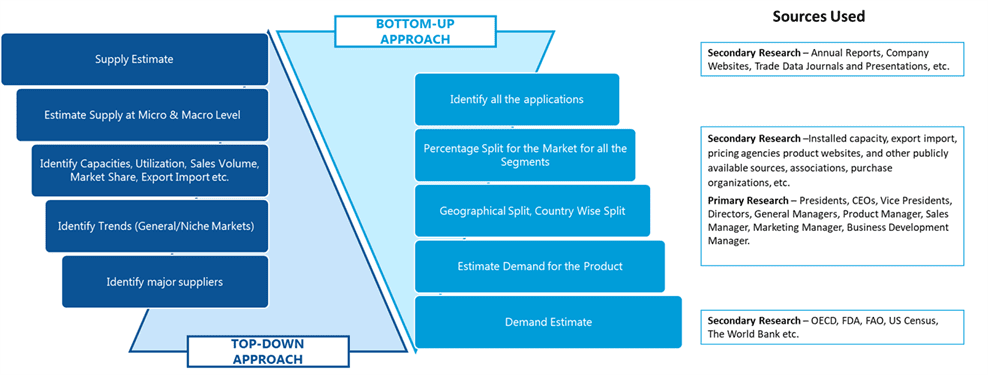

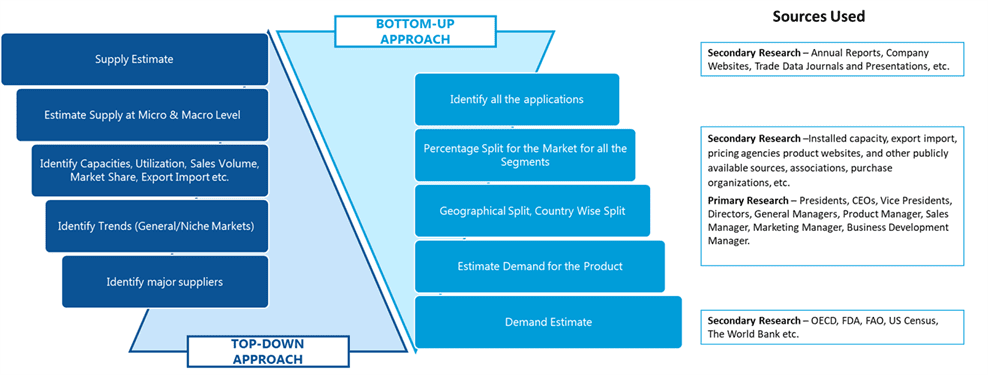

SDMR employs a three way data triangulation approach to arrive at market estimates. We use primary research, secondary research and data triangulation by top down and bottom up approach

Secondary Research:

Our research methodology involves in-depth desk research using various secondary sources. Data is gathered from association/government publications/databases, company websites, press releases, annual reports/presentations/sec filings, technical papers, journals, research papers, magazines, conferences, tradeshows, and blogs.

Key Data Points through secondary research-

Macro-economic data points

Import Export data

Identification of major market trends across various applications

Primary understanding of the industry for both the regions

Competitors analysis for the production capacities, key production sites, competitive landscape

Key customers

Production Capacity

Pricing Scenario

Cost Margin Analysis

Key Data Points through primary research-

Major factors driving the market and its end application markets

Comparative analysis and customer analysis

Regional presence

Collaborations or tie-ups

Annual Production, and sales

Profit Margins

Average Selling Price

Data Triangulation:

Data triangulation is done using top down and bottom approaches. However, to develop accurate market sizing estimations, both the methodologies are used to accurately arrive at the market size. Insert Image