Healthcare information technology proffers solutions for security and data management of information related with healthcare. Nowadays, information technology has more impact on the cost quality and safety associated with healthcare. Some widely used applications in the healthcare industry include electronic medical records, healthcare records and personal health records.

Technological advancement coupled with increasing demand for point of care diagnostics and therapeutics is expected to drive the growth of healthcare information system over the forecast period. Furthermore, key advantages associated with healthcare information system is that critical patient data is stored on a cloud or a remote server which can be seen and analyzed by a healthcare practitioner at any time on a smart phone, tablet or a personal computer from any location. Economic recession has forced a lot of healthcare establishments to reduce the cost of their operation by streamlining the entire process which is expected to positively reinforce the market.

During the forecast period, the Europe and North America region is anticipated to remain dominant in the global market for healthcare information systems owing to rising demand for better facilities of healthcare and increasing needs of integrated system of healthcare. Also, the APAC region is estimated to exhibit higher growth rate owing to the growing market demand of healthcare information systems in various emerging markets.

In 2018, the global Healthcare Information Systems market size was xx million US$ and it is expected to reach xx million US$ by the end of 2025, with a CAGR of xx% during 2019-2025.

This report focuses on the global Healthcare Information Systems status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Healthcare Information Systems development in United States, Europe and China.

The key players covered in this study

Philips healthcare

GE healthcare

Epic Systems Corporation

NextGen healthcare information systems

Carestream health

Siemens healthcare

Merge healthcare

Cerner Corporation

McKesson Corporation

Market segment by Type, the product can be split into

Software

Hardware

Services

Market segment by Application, split into

Hospital

Pharmacy

Laboratory

Market segment by Regions/Countries, this report covers

United States

Europe

China

Japan

Southeast Asia

India

Central & South America

The study objectives of this report are:

To analyze global Healthcare Information Systems status, future forecast, growth opportunity, key market and key players.

To present the Healthcare Information Systems development in United States, Europe and China.

To strategically profile the key players and comprehensively analyze their development plan and strategies.

To define, describe and forecast the market by product type, market and key regions.

In this study, the years considered to estimate the market size of Healthcare Information Systems are as follows:

History Year: 2014-2018

Base Year: 2018

Estimated Year: 2019

Forecast Year 2019 to 2025

For the data information by region, company, type and application, 2018 is considered as the base year. Whenever data information was unavailable for the base year, the prior year has been considered.

Table of Contents

1 Report Overview

1.1 Study Scope

1.2 Key Market Segments

1.3 Players Covered

1.4 Market Analysis by Type

1.4.1 Global Healthcare Information Systems Market Size Growth Rate by Type (2014-2025)

1.4.2 Software

1.4.3 Hardware

1.4.4 Services

1.5 Market by Application

1.5.1 Global Healthcare Information Systems Market Share by Application (2014-2025)

1.5.2 Hospital

1.5.3 Pharmacy

1.5.4 Laboratory

1.6 Study Objectives

1.7 Years Considered

2 Global Growth Trends

2.1 Healthcare Information Systems Market Size

2.2 Healthcare Information Systems Growth Trends by Regions

2.2.1 Healthcare Information Systems Market Size by Regions (2014-2025)

2.2.2 Healthcare Information Systems Market Share by Regions (2014-2019)

2.3 Industry Trends

2.3.1 Market Top Trends

2.3.2 Market Drivers

2.3.3 Market Opportunities

3 Market Share by Key Players

3.1 Healthcare Information Systems Market Size by Manufacturers

3.1.1 Global Healthcare Information Systems Revenue by Manufacturers (2014-2019)

3.1.2 Global Healthcare Information Systems Revenue Market Share by Manufacturers (2014-2019)

3.1.3 Global Healthcare Information Systems Market Concentration Ratio (CR5 and HHI)

3.2 Healthcare Information Systems Key Players Head office and Area Served

3.3 Key Players Healthcare Information Systems Product/Solution/Service

3.4 Date of Enter into Healthcare Information Systems Market

3.5 Mergers & Acquisitions, Expansion Plans

4 Breakdown Data by Type and Application

4.1 Global Healthcare Information Systems Market Size by Type (2014-2019)

4.2 Global Healthcare Information Systems Market Size by Application (2014-2019)

5 United States

5.1 United States Healthcare Information Systems Market Size (2014-2019)

5.2 Healthcare Information Systems Key Players in United States

5.3 United States Healthcare Information Systems Market Size by Type

5.4 United States Healthcare Information Systems Market Size by Application

6 Europe

6.1 Europe Healthcare Information Systems Market Size (2014-2019)

6.2 Healthcare Information Systems Key Players in Europe

6.3 Europe Healthcare Information Systems Market Size by Type

6.4 Europe Healthcare Information Systems Market Size by Application

7 China

7.1 China Healthcare Information Systems Market Size (2014-2019)

7.2 Healthcare Information Systems Key Players in China

7.3 China Healthcare Information Systems Market Size by Type

7.4 China Healthcare Information Systems Market Size by Application

8 Japan

8.1 Japan Healthcare Information Systems Market Size (2014-2019)

8.2 Healthcare Information Systems Key Players in Japan

8.3 Japan Healthcare Information Systems Market Size by Type

8.4 Japan Healthcare Information Systems Market Size by Application

9 Southeast Asia

9.1 Southeast Asia Healthcare Information Systems Market Size (2014-2019)

9.2 Healthcare Information Systems Key Players in Southeast Asia

9.3 Southeast Asia Healthcare Information Systems Market Size by Type

9.4 Southeast Asia Healthcare Information Systems Market Size by Application

10 India

10.1 India Healthcare Information Systems Market Size (2014-2019)

10.2 Healthcare Information Systems Key Players in India

10.3 India Healthcare Information Systems Market Size by Type

10.4 India Healthcare Information Systems Market Size by Application

11 Central & South America

11.1 Central & South America Healthcare Information Systems Market Size (2014-2019)

11.2 Healthcare Information Systems Key Players in Central & South America

11.3 Central & South America Healthcare Information Systems Market Size by Type

11.4 Central & South America Healthcare Information Systems Market Size by Application

12 International Players Profiles

12.1 Philips healthcare

12.1.1 Philips healthcare Company Details

12.1.2 Company Description and Business Overview

12.1.3 Healthcare Information Systems Introduction

12.1.4 Philips healthcare Revenue in Healthcare Information Systems Business (2014-2019)

12.1.5 Philips healthcare Recent Development

12.2 GE healthcare

12.2.1 GE healthcare Company Details

12.2.2 Company Description and Business Overview

12.2.3 Healthcare Information Systems Introduction

12.2.4 GE healthcare Revenue in Healthcare Information Systems Business (2014-2019)

12.2.5 GE healthcare Recent Development

12.3 Epic Systems Corporation

12.3.1 Epic Systems Corporation Company Details

12.3.2 Company Description and Business Overview

12.3.3 Healthcare Information Systems Introduction

12.3.4 Epic Systems Corporation Revenue in Healthcare Information Systems Business (2014-2019)

12.3.5 Epic Systems Corporation Recent Development

12.4 NextGen healthcare information systems

12.4.1 NextGen healthcare information systems Company Details

12.4.2 Company Description and Business Overview

12.4.3 Healthcare Information Systems Introduction

12.4.4 NextGen healthcare information systems Revenue in Healthcare Information Systems Business (2014-2019)

12.4.5 NextGen healthcare information systems Recent Development

12.5 Carestream health

12.5.1 Carestream health Company Details

12.5.2 Company Description and Business Overview

12.5.3 Healthcare Information Systems Introduction

12.5.4 Carestream health Revenue in Healthcare Information Systems Business (2014-2019)

12.5.5 Carestream health Recent Development

12.6 Siemens healthcare

12.6.1 Siemens healthcare Company Details

12.6.2 Company Description and Business Overview

12.6.3 Healthcare Information Systems Introduction

12.6.4 Siemens healthcare Revenue in Healthcare Information Systems Business (2014-2019)

12.6.5 Siemens healthcare Recent Development

12.7 Merge healthcare

12.7.1 Merge healthcare Company Details

12.7.2 Company Description and Business Overview

12.7.3 Healthcare Information Systems Introduction

12.7.4 Merge healthcare Revenue in Healthcare Information Systems Business (2014-2019)

12.7.5 Merge healthcare Recent Development

12.8 Cerner Corporation

12.8.1 Cerner Corporation Company Details

12.8.2 Company Description and Business Overview

12.8.3 Healthcare Information Systems Introduction

12.8.4 Cerner Corporation Revenue in Healthcare Information Systems Business (2014-2019)

12.8.5 Cerner Corporation Recent Development

12.9 McKesson Corporation

12.9.1 McKesson Corporation Company Details

12.9.2 Company Description and Business Overview

12.9.3 Healthcare Information Systems Introduction

12.9.4 McKesson Corporation Revenue in Healthcare Information Systems Business (2014-2019)

12.9.5 McKesson Corporation Recent Development

13 Market Forecast 2019-2025

13.1 Market Size Forecast by Regions

13.2 United States

13.3 Europe

13.4 China

13.5 Japan

13.6 Southeast Asia

13.7 India

13.8 Central & South America

13.9 Market Size Forecast by Product (2019-2025)

13.10 Market Size Forecast by Application (2019-2025)

14 Analyst's Viewpoints/Conclusions

15 Appendix

15.1 Research Methodology

15.1.1 Methodology/Research Approach

15.1.1.1 Research Programs/Design

15.1.1.2 Market Size Estimation

12.1.1.3 Market Breakdown and Data Triangulation

15.1.2 Data Source

15.1.2.1 Secondary Sources

15.1.2.2 Primary Sources

15.2 Disclaimer

15.3 Author Details

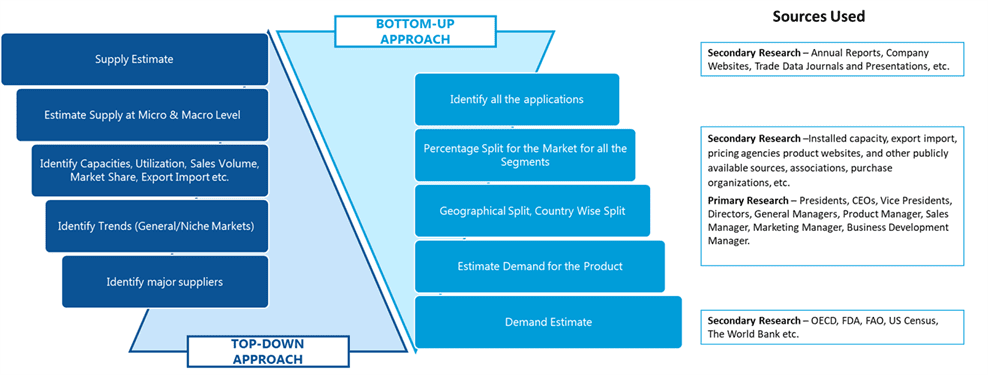

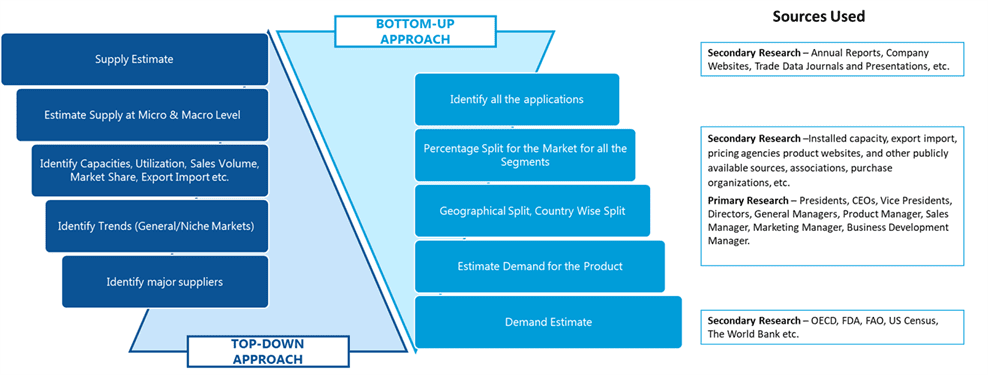

SDMR employs a three way data triangulation approach to arrive at market estimates. We use primary research, secondary research and data triangulation by top down and bottom up approach

Secondary Research:

Our research methodology involves in-depth desk research using various secondary sources. Data is gathered from association/government publications/databases, company websites, press releases, annual reports/presentations/sec filings, technical papers, journals, research papers, magazines, conferences, tradeshows, and blogs.

Key Data Points through secondary research-

Macro-economic data points

Import Export data

Identification of major market trends across various applications

Primary understanding of the industry for both the regions

Competitors analysis for the production capacities, key production sites, competitive landscape

Key customers

Production Capacity

Pricing Scenario

Cost Margin Analysis

Key Data Points through primary research-

Major factors driving the market and its end application markets

Comparative analysis and customer analysis

Regional presence

Collaborations or tie-ups

Annual Production, and sales

Profit Margins

Average Selling Price

Data Triangulation:

Data triangulation is done using top down and bottom approaches. However, to develop accurate market sizing estimations, both the methodologies are used to accurately arrive at the market size. Insert Image