The global agricultural films market was valued at $ 8.3 billion in 2017 and is expected to grow at 6.0% CAGR during 2017-2023 and reach at $ 11.2 billion 2023. The increasing drought affected land, decreasing arable lands and growing demand of the food, fruits and vegetables are the primary factors for the growth of agricultural films market.

In terms of types of agricultural films, Linear Low Density Polyethylene (LLDPE) agricultural film is expected to account for the largest market share and is projected to lead the market over the forecast period. LLDPE film is highly demanded by the consumers because of its moisture barrier, mechanical properties, high resistance of sunlight and optical properties. LLDPE and LDPE are in high demand in Asia Pacific region due to the scarcity of water. High Density Polyethylene (HDPE) and Low Density Polyethylene (LDPE) and Ethylene Vinyl Acetate (EVA) are other popular agricultural films.

Mulch film was the largest market segment in 2017 and is expected to grow at highest growth during the forecast period. The mulch films are highly suitable for the supressing the weed growth, regulating and conserving the soil moisture and maintaining a good root zone. Greenhouse films are expected to grow at 10.6% CAGR over the forecast period. Rising demand for flowers and vegetables in resulting in growth of floriculture & horticulture. Coupled with demand of greenhouse films in floriculture & horticulture, adverse climatic conditions are expected to result in market growth of agricultural films.

In terms of colors, black, black/white and black/silver are the most demanded color in mulch film. Black mulch films are highly resistant to sunlight and controls the weed growth. Transparent is the most preferred color in greenhouse films and plastic tunnels. The transparent or clear agricultural film provides the fruits and vegetables from frost, rain, snow and wind, the controlled exposure of sunlight helps vegetables and flowers to ripen faster.

Asia Pacific was the leading region in 2017 and is expected to remain a market leader over the forecast period. Increasing government initiatives in many countries such as India, China for research and development of protected agricultural practices are the major factors for driving the market growth in the region. China is estimated to be the fastest growing country in agricultural films over the 2023. North America and Europe are expected to witness an average growth during 2017-2023 due to the stringent regulations regarding the usage and disposal of the agricultural films.

Many companies are working closely with the farmers and consumers to address the need and desired qualities in agricultural films. In 2016, BASF launched a bio-degradable premium-polymer “ecovio”. The ecovio films can be ploughed back into the soil, where they biodegrade which saves time and in money. Some of the other important players operating in agricultural film market are BASF, Kuraray, Essen Multipack, Ginegar Plastics, AT Films, Berry Global, Plastika Kritis S.A., Trioplast Industrier AB , Coveris, Britton Group Limited, Agri Plast Tech India Pvt. Ltd., Plastik V SDN BHD, Ab Rani Plast Oy, Grupo Armando Alvarez, The DOW Chemical Company, RPC Group PLC, Rival Tech China and Shandong Shouguang Longxing Agricultural Film Co., Ltd.

1. Introduction

1.1. Goal & Objective

1.2. Report Coverage

1.3. Supply Side Data Modelling & Methodology

1.4. Demand Side Data Modelling & Methodology

2. Executive Summary

3. Market Outlook

3.1. Introduction

3.2. Current & Future Outlook

3.3. DROC

3.3.1. Drivers

3.3.1.1. Demand Drivers

3.3.1.2. Supply Drivers

3.3.2. Restraints

3.3.3. Opportunities

3.3.4. Challenges

3.4. Market Entry Matrix

3.5. Market Opportunity Analysis

3.6. Market Regulations

3.7. Pricing Mix

3.8. Value Chain & Ecosystem

3.9. Key Customers

4. Market Demand Analysis

4.1. Agricultural Films Market, By Type

4.1.1. Introduction

4.1.2. High Density Polyethylene (HDPE)

4.1.3. Low Density Polyethylene (LDPE)

4.1.4. Linear Low Density Polyethylene (LLDPE)

4.1.5. Ethylene Vinyl Acetate (EVA)

4.1.6. Reclaim Polyethylene Reclaim PE)

5. Agricultural Films Market, By Application

5.1. Introduction

5.2. Green House

5.3. Plastic Tunnels

5.3.1. Walking Tunnels

5.3.2. Tow Tunnels

5.4. Mulch films

5.5. Silage

5.5.1. Silage films/wraps

5.5.2. Silo bags

6. Agricultural Films Market, By Application By Color

6.1. Green house

6.1.1. Transparent

6.1.2. Green

6.1.3. Yellow

6.1.4. Others

6.2. Plastic tunnels

6.2.1. Transparent

6.2.2. Green

6.2.3. Yellow

6.2.4. Others

6.3. Mulch

6.3.1. Transparent

6.3.2. Black

6.3.3. Black/white

6.3.4. Black/silver

6.3.5. OthersS

7. Agricultural Films Market, By Region

7.1. Introduction

7.2. North America

7.2.1. U.S.A

7.2.2. Canada

7.2.3. Mexico

7.3. Asia Pacific

7.3.1. China

7.3.2. Japan

7.3.3. South Korea

7.3.4. India

7.3.5. Australia

7.3.6. Others

7.4. Europe

7.4.1. Germany

7.4.2. UK

7.4.3. Sweden

7.4.4. France

7.4.5. Italy

7.4.6. Others

7.5. Middle East & Africa

7.5.1. Saudi Arabia

7.5.2. UAE

7.5.3. Others

7.6. South America

7.6.1. Brazil

7.6.2. Argentina

7.6.3. Others

8. Supply Market Analysis (Industry Player Analysis)

8.1. Strategic Benchmarking

8.2. Market Share Analysis

8.3. Key Players ((Company Snapshot, Product Portfolio, Financials, and Strategic Analysis)

8.3.1. BASF

8.3.2. Kuraray

8.3.3. Essen Multipack

8.3.4. Ginegar Plastics

8.3.5. AT Films

8.3.6. Berry Global

8.3.7. Plastika Kritis S.A.

8.3.8. Trioplast Industrier AB

8.3.9. Coveris

8.3.10. Britton Group Limited

8.3.11. Agri Plast Tech India Pvt. Ltd.

8.3.12. Plastik V SDN BHD

8.3.13. Ab Rani Plast Oy

8.3.14. Grupo Armando Alvarez

8.3.15. he DOW Chemical Company

8.3.16. RPC Group PLC

8.3.17. Rival Tech China

8.3.18. Shandong Shouguang Longxing Agricultural Film Co., Ltd

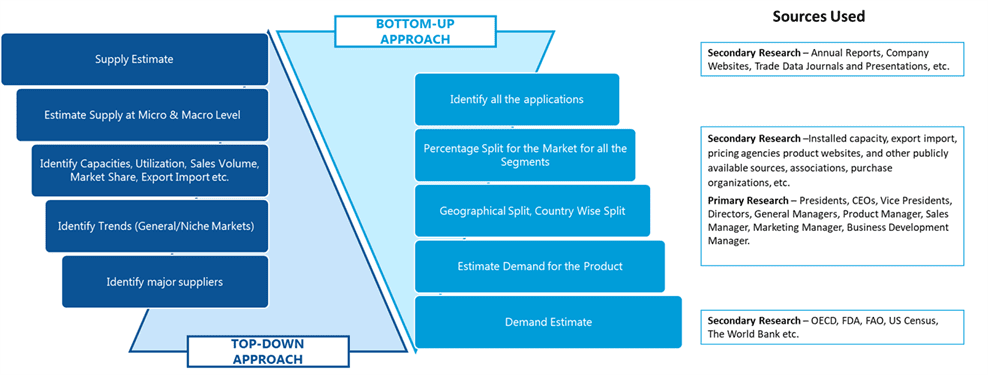

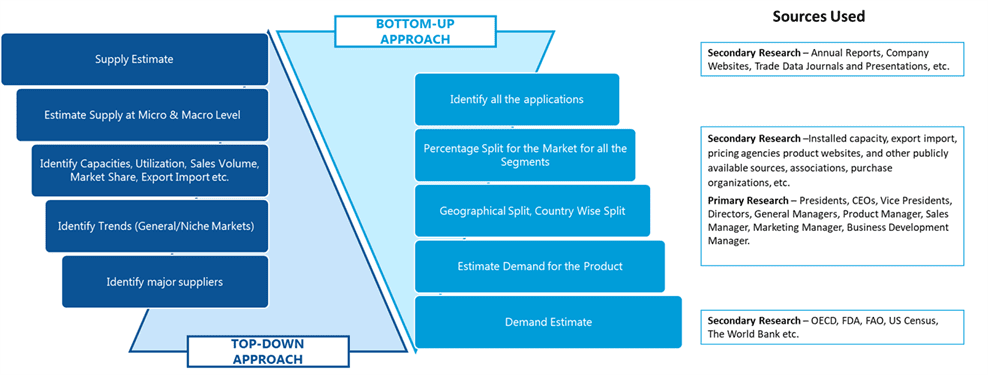

SDMR employs a three way data triangulation approach to arrive at market estimates. We use primary research, secondary research and data triangulation by top down and bottom up approach

Secondary Research:

Our research methodology involves in-depth desk research using various secondary sources. Data is gathered from association/government publications/databases, company websites, press releases, annual reports/presentations/sec filings, technical papers, journals, research papers, magazines, conferences, tradeshows, and blogs.

Key Data Points through secondary research-

Macro-economic data points

Import Export data

Identification of major market trends across various applications

Primary understanding of the industry for both the regions

Competitors analysis for the production capacities, key production sites, competitive landscape

Key customers

Production Capacity

Pricing Scenario

Cost Margin Analysis

Key Data Points through primary research-

Major factors driving the market and its end application markets

Comparative analysis and customer analysis

Regional presence

Collaborations or tie-ups

Annual Production, and sales

Profit Margins

Average Selling Price

Data Triangulation:

Data triangulation is done using top down and bottom approaches. However, to develop accurate market sizing estimations, both the methodologies are used to accurately arrive at the market size. Insert Image