The research of cationic Surfactants market mainly focuses on North America, Europe, Asia pacific (excluding China) and China covering:

Market participants of anionic surfactants:

Producers (active, potential producers)

End users

Raw materials suppliers

Formulators

Major traders

Application areas

Household detergents

Personal care

Fabric softeners

Industrial / Commercial / Institutional

Others

Cationic surfactants type

Fat or Fatty acid derivatives

Fatty nitrile derivatives

Fatty alcohol or olefin derived

Anionic surfactants market analysis

Consumption trends and forecast

Value chain analysis

Price analytics

Company analysis

Company profiles of the key producers*

Company introduction

SWOT analysis in terms of cationic surfactants

Financial analysis

Employee and R&D details

Products offerings

Plant locations

Installed capacity of cationic surfactants

Strategic imperatives

How this report will add value to your organisation

This report provides the in-depth analysis of the complete value chain of the Cationic Surfactants market from the raw material suppliers to the end users. We have critically analysed following parameters and their impact in the industry:

1. Improvement in top line and bottom line growth

Analysis trend & forecasts by end use markets such as agrochemicals, pharma etc. will help you to understand how the growth in consumption is expected in next 5 years and what will be the key factors that will support the growth. This will help to make a clear plan for the top line growth. Price analytics will also play a crucial role in making a plan for top line growth.

Raw material and other input factors analysis will help to plan effectively for the bottom line.

2. Competitive intelligence

In a competitive marketplace, up-to-date information can make the difference between keeping pace, getting ahead, or being left behind. A smart intelligence operation can serve as an early-warning system for disruptive changes in the competitive landscape, whether that change is a rival's new product or pricing strategy or the entrance of an unexpected player into your market.

We also provide you with information that allows you to anticipate what your competitors are planning next. For example, you might gain information on a new product they are getting ready to launch or new services they will add to the business. Hiring us to handle this information collection saves you time and energy, allowing you to focus on your own business while still gaining the necessary knowledge to keep track of competitors.

3. Identification of prospective customers and their satisfaction level with the current supplier:

We have provided the long list of customers and analysed them critically, based on various parameters such as anionic surfactants consumption, market type, sustainable business etc. this will help your organisation to develop relations with these consumers of anionic surfactants. Also we have identified the factors in which the others customer will switch to you.

Methodology and sources

We follow the following steps to complete the report:

Desk research

Market size, capacity and production information

The sources of desk research are various, including published magazines, journals, government statistics, industrial statistics, customs statistics, association seminars as well as information from the Internet.

A lot of work goes into compilation and analysis of the obtained information.

Analysis of import & export data

Preliminary analysis of import & export situation of cationic surfactants in order to:

Evaluate the import & export situation

Evaluate the role of overseas products in domestic market

Primary research

We carry out extensive telephone interviews across the value chain in order to survey the actual market situation of anionic surfactants. The interviewees will cover:

Major producers

Major customers across various market segments

Key traders

Raw materials suppliers

Industry associations

Industry experts

Bottom-up research

According to telephone interviews, matrix excel is designed to deal with complicated and abundant data that are mainly about capacity, output and consumption. Based on the consumption data in the past from 2010 to 2015, future demand data from 2016 to 2021 is forecasted with the method of bottom-up research.

Report generation

Logical analysis and scientific ratiocination will be conducted to generate the report. All the data and findings obtained in the above stages are presented in the report clearly.

1. Executive summary

2. Brief overview of global surfactants industry

2.1. Surfactants classification

2.2. Market segmentation of surfactants

3. Introduction of cationic surfactants industry

3.1. Evolution of the cationic surfactants industry

3.2. Cationic surfactants industry structure

3.3. Porter five forces analysis for the cationic surfactants industry

3.4. Value chain analysis

3.5. Regulations

4. Global market analysis – Current market for 2015 trends from 2010 to 2015 and forecast from 2016 to 2021 by:

4.1. Fat or Fatty acid derivatives

4.1.1. Household detergents

4.1.2. Personal care

4.1.3. Fabric softeners

4.1.4. Industrial / Commercial / Institutional

4.1.5. Others

4.2. Fatty nitrile derivatives

4.2.1. Personal care

4.2.2. Fabric softeners

4.2.3. Industrial / Commercial / Institutional

4.2.4. Others

4.3. Fatty alcohol or olefin derived

4.3.1. Household detergents

4.3.2. Personal care

4.3.3. Industrial / Commercial / Institutional

4.3.4. Others

5. North America market analysis – Current market for 2015 trends from 2010 to 2015 and forecast from 2016 to 2021 by

5.1. Fat or Fatty acid derivatives

5.1.1. Household detergents

5.1.2. Personal care

5.1.3. Fabric softeners

5.1.4. Industrial / Commercial / Institutional

5.1.5. Others

5.2. Fatty nitrile derivatives

5.2.1. Personal care

5.2.2. Fabric softeners

5.2.3. Industrial / Commercial / Institutional

5.2.4. Others

5.3. Fatty alcohol or olefin derived

5.3.1. Household detergents

5.3.2. Personal care

5.3.3. Industrial / Commercial / Institutional

5.3.4. Others

5.4. Key growth drivers

5.5. Key challenges

5.6. Competitive benchmarking of key players*

5.6.1. ABITEC Corporation

5.6.2. Akzo Nobel Inc

5.6.3. Albemarle Corporation

5.6.4. Ashland Inc.

5.6.5. Baker Petrolite Corporation (subsidiary of Baker Hughes Inc.)

5.6.6. BASF Corporation

5.6.7. Cedar Concepts Corp.

5.6.8. Clariant Corporation

5.6.9. Croda, Inc.

5.6.10. The Dow Chemical Company

5.6.11. Harcros Chemicals Inc.

5.6.12. Innospec Active Chemicals LLC

5.6.13. Kao Specialties Americas LLC

5.6.14. Lonza Inc

5.6.15. Lubrizol Corporation

5.6.16. Nalco Company

5.6.17. OMNOVA Solutions Inc.

5.6.18. Petroferm Inc.

5.6.19. The Procter & Gamble Company Procter & Gamble Chemicals

5.6.20. Rhodia Inc. Consumer Specialties Division

5.6.21. Scholler, Inc.

5.6.22. Stepan Company

5.6.23. Textile Rubber & Chemical Co.

5.6.24. QuímiKao, S.A. de C.V.

5.6.25. Stepan México, S.A. de C.V.

6. Western Europe market analysis – Current market for 2015 trends from 2010 to 2015 and forecast from 2016 to 2021 by

6.1. Fat or Fatty acid derivatives

6.1.1. Household detergents

6.1.2. Personal care

6.1.3. Fabric softeners

6.1.4. Industrial / Commercial / Institutional

6.1.5. Others

6.2. Fatty nitrile derivatives

6.2.1. Personal care

6.2.2. Fabric softeners

6.2.3. Industrial / Commercial / Institutional

6.2.4. Others

6.3. Fatty alcohol or olefin derived

6.3.1. Household detergents

6.3.2. Personal care

6.3.3. Industrial / Commercial / Institutional

6.3.4. Others

6.4. Key growth drivers

6.5. Key challenges

6.6. Competitive benchmarking of key players*

6.6.1. Akzo Nobel Surface Chemistry AB

6.6.2. BASF

6.6.3. CECA SA

6.6.4. Clariant Ibérica, S.A.

6.6.5. Clariant Produkte (Deutschland) GmbH

6.6.6. Croda Europe Ltd.

6.6.7. E & S Chimie S.A.S.

6.6.8. Elementis Specialties Netherlands BV

6.6.9. Erca SpA

6.6.10. Evonik Industries AG

6.6.11. FeF Chemicals

6.6.12. Huntsman Surface Sciences Italia Srl

6.6.13. Industria Chimica Panzeri Srl

6.6.14. Kao Chemicals GmbH

6.6.15. Kao Corporation, SA

6.6.16. Lamberti S.p.A.

6.6.17. Rhodia

6.6.18. Sabo S.R.L.

6.6.19. Stepan Europe S.A.

6.6.20. Wall Chemie GmbH

7. Asia pacific (excluding China) market analysis – Current market for 2015 trends from 2010 to 2015 and forecast from 2016 to 2021 by

7.1. Fat or Fatty acid derivatives

7.1.1. Household detergents

7.1.2. Personal care

7.1.3. Fabric softeners

7.1.4. Industrial / Commercial / Institutional

7.1.5. Others

7.2. Fatty nitrile derivatives

7.2.1. Personal care

7.2.2. Fabric softeners

7.2.3. Industrial / Commercial / Institutional

7.2.4. Others

7.3. Fatty alcohol or olefin derived

7.3.1. Household detergents

7.3.2. Personal care

7.3.3. Industrial / Commercial / Institutional

7.3.4. Others

7.4. Key growth drivers

7.5. Key challenges

7.6. Competitive benchmarking of key players*

7.6.1. ADEKA Corporation

7.6.2. Dai-ichi Kogyo Seiyaku Co., Ltd.

7.6.3. Kao Corporation

7.6.4. Lion Corporation

7.6.5. Matsumoto Yushi-Seiyaku Co., Ltd.

7.6.6. Miyoshi Oil & Fat Co., Ltd.

7.6.7. Nicca Chemical Co., Ltd.

7.6.8. Nikko Chemicals Co., Ltd.

7.6.9. Nippon Nyukazai Co., Ltd.

7.6.10. NOF Corporation

7.6.11. Procter & Gamble

7.6.12. Sanyo Chemical Industries, Ltd.

7.6.13. Toho Chemical Industry Co., Ltd.

7.6.14. Yokkaichi Chemical Co., Ltd.

7.6.15. AK ChemTech Co., Ltd.

7.6.16. Miwon Commercial Co., Ltd.

7.6.17. Taiwan NJC Corp

7.6.18. Taiwan Surfactant Corp.

7.6.19. Yushiro Chemical Industry Co., Ltd.

7.6.20. Dongnam Chemical Ind. Co., Ltd.

7.6.21. Sino-Japan Chemical Co., Ltd.

7.6.22. Taiwan Nicca Chemical Industrial

7.6.23. Dishman Pharmaceuticals & Chemicals Pvt. Ltd

8. Chinese market analysis – Current market for 2015 trends from 2010 to 2015 and forecast from 2016 to 2021 by

8.1. Fat or Fatty acid derivatives

8.1.1. Household detergents

8.1.2. Personal care

8.1.3. Fabric softeners

8.1.4. Industrial / Commercial / Institutional

8.1.5. Others

8.2. Fatty nitrile derivatives

8.2.1. Personal care

8.2.2. Fabric softeners

8.2.3. Industrial / Commercial / Institutional

8.2.4. Others

8.3. Fatty alcohol or olefin derived

8.3.1. Household detergents

8.3.2. Personal care

8.3.3. Industrial / Commercial / Institutional

8.3.4. Others

8.4. Key growth drivers

8.5. Key challenges

8.6. Competitive benchmarking of key players*

8.6.1. Sinopec International Co., Ltd.

8.6.2. Lianzhou Chemical Company

8.6.3. Guanzhou Fine Chemical Industry Co.

8.6.4. Henan Province Hebi Fertilizer Plant

8.6.5. Hunan Resun Aowei Co., Ltd.

8.6.6. Xiangtang City Fine Chemical Factory

8.6.7. Jiangsu Feixiang Chemical (Zhangjiagang) Co., Ltd. (Akzo Nobel)

8.6.8. Nanjing Spec-Chem Industry Inc.

8.6.9. Dalian Oil and Fat Chemical Plant

8.6.10. Lushun Fertilizer Plant Dalian

8.6.11. China Resource (Boxing) Chemical Co., Ltd.

8.6.12. Shandong Binzhou Chemical Fertilizer Factory

8.6.13. Shandong Liborihua Co., Ltd.

8.6.14. Shanghai Wujing Chemical Co. Ltd

8.6.15. Lutianhua Gr. Inc. Luzhou

8.6.16. Tianjin Haoyuan Fine Chemical Co., Ltd.

8.6.17. Tianjin Tian Zhi Fine Chemical Co., Ltd.

9. Rest of world market analysis – Current market for 2015 trends from 2010 to 2015 and forecast from 2016 to 2021 by

9.1. Fat or Fatty acid derivatives

9.1.1. Household detergents

9.1.2. Personal care

9.1.3. Fabric softeners

9.1.4. Industrial / Commercial / Institutional

9.1.5. Others

9.2. Fatty nitrile derivatives

9.2.1. Personal care

9.2.2. Fabric softeners

9.2.3. Industrial / Commercial / Institutional

9.2.4. Others

9.3. Fatty alcohol or olefin derived

9.3.1. Household detergents

9.3.2. Personal care

9.3.3. Industrial / Commercial / Institutional

9.3.4. Others

9.4. Key growth drivers

9.5. Key challenges

9.6. Competitive benchmarking of key players*

9.6.1. South America

9.6.1.1. Clariant (Argentina) SA

9.6.1.2. Akzo Nobel Ltda.

9.6.1.3. BASF S.A.

9.6.1.4. Clariant S.A.

9.6.1.5. Ecadil Indústria Química S.A.

9.6.1.6. Evonik Brasil Ltda.

9.6.1.7. Hester Química do Brasil Ltda.

9.6.1.8. Inpal S.A. Indústrias Químicas

9.6.1.9. Resinac Indústrias Químicas Ltda

9.6.1.10. Rhodia Brasil Ltda.

9.6.1.11. Química Rhenium Ltda.

9.6.2. Eastern Europe

9.6.2.1. Enaspol, a.s.

9.6.3. Middle East

9.6.3.1. Zohar Dalia

10. Conclusion

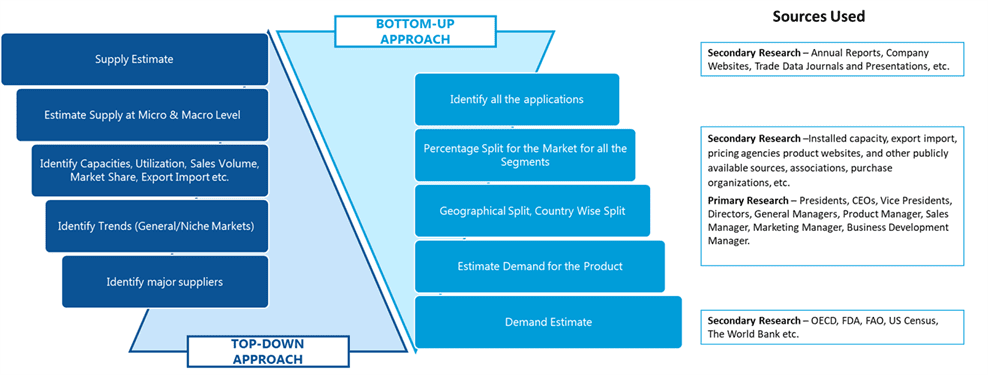

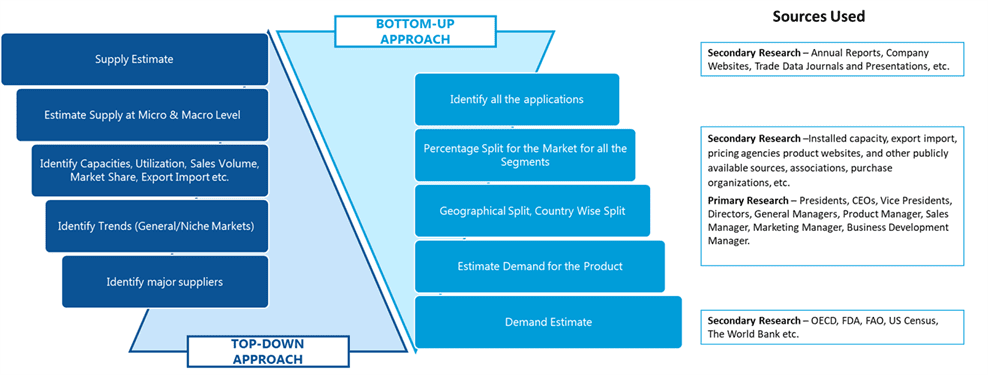

SDMR employs a three way data triangulation approach to arrive at market estimates. We use primary research, secondary research and data triangulation by top down and bottom up approach

Secondary Research:

Our research methodology involves in-depth desk research using various secondary sources. Data is gathered from association/government publications/databases, company websites, press releases, annual reports/presentations/sec filings, technical papers, journals, research papers, magazines, conferences, tradeshows, and blogs.

Key Data Points through secondary research-

Macro-economic data points

Import Export data

Identification of major market trends across various applications

Primary understanding of the industry for both the regions

Competitors analysis for the production capacities, key production sites, competitive landscape

Key customers

Production Capacity

Pricing Scenario

Cost Margin Analysis

Key Data Points through primary research-

Major factors driving the market and its end application markets

Comparative analysis and customer analysis

Regional presence

Collaborations or tie-ups

Annual Production, and sales

Profit Margins

Average Selling Price

Data Triangulation:

Data triangulation is done using top down and bottom approaches. However, to develop accurate market sizing estimations, both the methodologies are used to accurately arrive at the market size. Insert Image