The research of Emollients, Film formers, Moisturizer Chemicals used in Cosmetics market mainly focuses on North America, Europe, Asia (excluding and China) and China covering:

Market participants of Emollients, Film formers, Moisturizer Chemicals used in Cosmetics:

Producers (active, potential producers)

End users

Raw material suppliers

Major traders

Application areas

Emollients, film formers and moisturizer chemicals in cosmetic applications

Market analysis

Capacity

Production

Consumption trends and forecast

Value chain analysis

Price analysis

Regions / countries

North America

Western Europe

Asia pacific excluding China

China

How this report will add value to your organisation

This report provides the in-depth analysis of the complete value chain from the raw material suppliers to the end users. We have critically analysed following parameters and their impact in the industry:

1. Improvement in top line and bottom line growth

Analysis trend & forecasts by end use markets will help you to understand how the growth in consumption is expected in next 5 years and what will be the key factors that will support the growth. This will help to make a clear plan for the top line growth. Price analytics will also play a crucial role in making a plan for top line growth.

Raw material and other input factors analysis will help to plan effectively for the bottom line.

2. Competitive intelligence

In a competitive marketplace, up-to-date information can make the difference between keeping pace, getting ahead, or being left behind. A smart intelligence operation can serve as an early-warning system for disruptive changes in the competitive landscape, whether that change is a rival's new product or pricing strategy or the entrance of an unexpected player into your market.

We also provide you with information that allows you to anticipate what your competitors are planning next. For example, you might gain information on a new product they are getting ready to launch or new services they will add to the business. Hiring us to handle this information collection saves you time and energy, allowing you to focus on your own business while still gaining the necessary knowledge to keep track of competitors.

3. Identification of prospective customers and their satisfaction level with the current supplier:

We have provided the long list of customers and analysed them critically, based on various parameters such as consumption, market type, sustainable business etc. this will help your organisation to develop relations with the consumers. Also, we have identified the factors in which the others customer will switch to you.

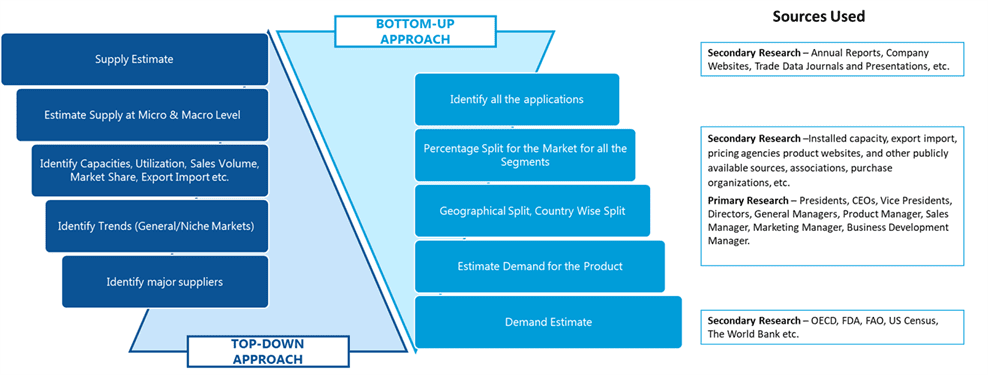

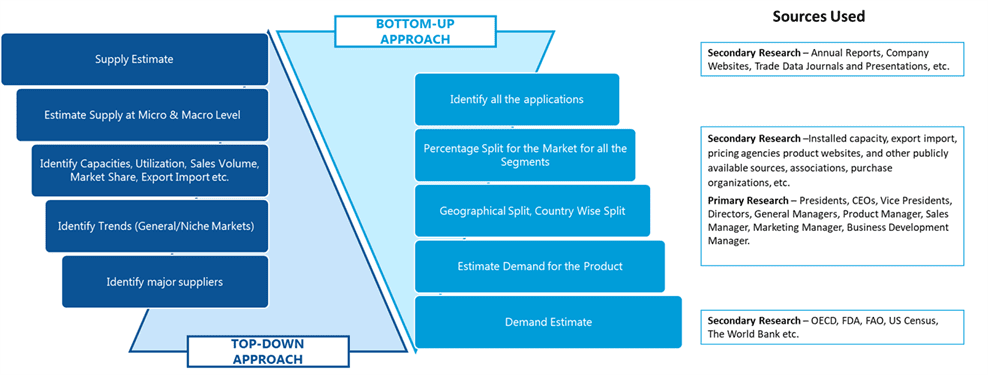

Methodology and sources

We follow the following steps to complete the report:

Desk research

Market size, capacity and production information are based on the following:

The sources of desk research are various, including published magazines, journals, government statistics, industrial statistics, customs statistics, association seminars as well as information from the Internet.

A lot of work goes into compilation and analysis of the obtained information.

Analysis of import & export data

Preliminary analysis of import & export situation in order to:

Evaluate the import & export situation

Evaluate the role of overseas products in domestic market

Evaluate the role of Indian products in international market.

Primary research

We carry out extensive telephone interviews across the value chain in order to survey the actual market situation. The interviewees we covered are:

Major producers

Major customers

Key traders

Raw materials suppliers

Industry associations

Bottom-up research

According to telephone interviews, matrix excel is designed to deal with complicated and abundant data that are mainly about capacity, output and consumption. Based on the consumption data for 2016 and future demand data from 2017 to 2022 is forecasted with the method of bottom-up research.

Report generation

Logical analysis and scientific ratiocination will be conducted to generate the report. All the data and findings obtained in the above stages are presented in the report clearly.

In this report, we have provided the detailed analysis of more than 80 companies which produce / supply different types of cosmetic chemicals

1. Executive summary

2. Brief Introduction of cosmetic chemicals industry

2.1. Overview

2.2. Product Identification

2.3. Brief overview of global cosmetic chemicals industry by following categories:

2.3.1. Emollients, film formers and moisturizers

2.3.2. Surfactants

2.3.3. Thickening agents

2.3.4. Colorants and pearlescent pigments

2.3.5. Preservatives

2.3.6. Carriers and Powders

2.3.7. Hair Conditioning Polymers

2.3.8. Hair Setting Resins

2.3.9. Antiperspirants and Deodorants

2.3.10. Sunscreen Chemicals

2.3.11. Antidandruff Agents

2.4. Value chain analysis

2.5. Porter five forces analysis of cosmetic chemicals market

2.6. Burning issues in the market such as regulations

2.7. Market dynamics

2.8. Raw material analysis

2.9. Policy and regulations

3. Global market analysis for Emollients, Film formers, Moisturizer Chemicals used in Cosmetics

3.1. Current market analysis for the year 2016

3.1.1. Polyols

3.1.1.1. Sorbitol

3.1.1.2. Glycerine

3.1.1.3. PEG

3.1.1.4. Propylene Glycol

3.1.1.5. Others

3.1.2. Hydrocarbons

3.1.2.1. White Oil / Paraffin Liquid

3.1.2.2. Petroleum Jellies

3.1.2.3. Microcrystalline wax

3.1.2.4. Squalane

3.1.3. Others

3.1.3.1. Silicones

3.1.3.2. Lanolin & derivatives

3.1.3.3. Esters

3.1.3.4. Natural wax

3.1.3.5. Fatty Alcohols

3.1.3.6. Fatty Acids

3.1.3.7. Triglycerides

3.1.3.8. Amino Acids and Polypeptides

3.1.3.9. Alkoxylates

3.1.3.10. Others

3.2. Forecast from 2017 to 2022

3.2.1. Polyols

3.2.1.1. Sorbitol

3.2.1.2. Glycerine

3.2.1.3. PEG

3.2.1.4. Propylene Glycol

3.2.1.5. Others

3.2.2. Hydrocarbons

3.2.2.1. White Oil / Paraffin Liquid

3.2.2.2. Petroleum Jellies

3.2.2.3. Microcrystalline wax

3.2.2.4. Squalane

3.2.3. Others

3.2.3.1. Silicones

3.2.3.2. Lanolin & derivatives

3.2.3.3. Esters

3.2.3.4. Natural wax

3.2.3.5. Fatty Alcohols

3.2.3.6. Fatty Acids

3.2.3.7. Triglycerides

3.2.3.8. Amino Acids and Polypeptides

3.2.3.9. Alkoxylates

3.2.3.10. Others

3.2.4. Key growth drivers

3.2.5. Key challenges

4. North America market analysis for Emollients, Film formers, Moisturizer Chemicals used in Cosmetics

4.1. Current market analysis for the year 2016

4.1.1. Polyols

4.1.1.1. Sorbitol

4.1.1.2. Glycerine

4.1.1.3. PEG

4.1.1.4. Propylene Glycol

4.1.1.5. Others

4.1.2. Hydrocarbons

4.1.2.1. White Oil / Paraffin Liquid

4.1.2.2. Petroleum Jellies

4.1.2.3. Microcrystalline wax

4.1.2.4. Squalane

4.1.3. Others

4.1.3.1. Silicones

4.1.3.2. Lanolin & derivatives

4.1.3.3. Esters

4.1.3.4. Natural wax

4.1.3.5. Fatty Alcohols

4.1.3.6. Fatty Acids

4.1.3.7. Triglycerides

4.1.3.8. Amino Acids and Polypeptides

4.1.3.9. Alkoxylates

4.1.3.10. Others

4.2. Forecast from 2017 to 2022

4.2.1. Polyols

4.2.1.1. Sorbitol

4.2.1.2. Glycerine

4.2.1.3. PEG

4.2.1.4. Propylene Glycol

4.2.1.5. Others

4.2.2. Hydrocarbons

4.2.2.1. White Oil / Paraffin Liquid

4.2.2.2. Petroleum Jellies

4.2.2.3. Microcrystalline wax

4.2.2.4. Squalane

4.2.3. Others

4.2.3.1. Silicones

4.2.3.2. Lanolin & derivatives

4.2.3.3. Esters

4.2.3.4. Natural wax

4.2.3.5. Fatty Alcohols

4.2.3.6. Fatty Acids

4.2.3.7. Triglycerides

4.2.3.8. Amino Acids and Polypeptides

4.2.3.9. Alkoxylates

4.2.3.10. Others

4.2.4. Key growth drivers

4.2.5. Key challenges

5. European market analysis for Emollients, Film formers, Moisturizer Chemicals used in Cosmetics

5.1. Current market analysis for the year 2016

5.1.1. Polyols

5.1.1.1. Sorbitol

5.1.1.2. Glycerine

5.1.1.3. PEG

5.1.1.4. Propylene Glycol

5.1.1.5. Others

5.1.2. Hydrocarbons

5.1.2.1. White Oil / Paraffin Liquid

5.1.2.2. Petroleum Jellies

5.1.2.3. Microcrystalline wax

5.1.2.4. Squalane

5.1.3. Others

5.1.3.1. Silicones

5.1.3.2. Lanolin & derivatives

5.1.3.3. Esters

5.1.3.4. Natural wax

5.1.3.5. Fatty Alcohols

5.1.3.6. Fatty Acids

5.1.3.7. Triglycerides

5.1.3.8. Amino Acids and Polypeptides

5.1.3.9. Alkoxylates

5.1.3.10. Others

5.2. Forecast from 2017 to 2022

5.2.1. Polyols

5.2.1.1. Sorbitol

5.2.1.2. Glycerine

5.2.1.3. PEG

5.2.1.4. Propylene Glycol

5.2.1.5. Others

5.2.2. Hydrocarbons

5.2.2.1. White Oil / Paraffin Liquid

5.2.2.2. Petroleum Jellies

5.2.2.3. Microcrystalline wax

5.2.2.4. Squalane

5.2.3. Others

5.2.3.1. Silicones

5.2.3.2. Lanolin & derivatives

5.2.3.3. Esters

5.2.3.4. Natural wax

5.2.3.5. Fatty Alcohols

5.2.3.6. Fatty Acids

5.2.3.7. Triglycerides

5.2.3.8. Amino Acids and Polypeptides

5.2.3.9. Alkoxylates

5.2.3.10. Others

5.2.4. Key growth drivers

5.2.5. Key challenges

6. China market analysis for Emollients, Film formers, Moisturizer Chemicals used in Cosmetics

6.1. Current market analysis for the year 2016

6.1.1. Polyols

6.1.1.1. Sorbitol

6.1.1.2. Glycerine

6.1.1.3. PEG

6.1.1.4. Propylene Glycol

6.1.1.5. Others

6.1.2. Hydrocarbons

6.1.2.1. White Oil / Paraffin Liquid

6.1.2.2. Petroleum Jellies

6.1.2.3. Microcrystalline wax

6.1.2.4. Squalane

6.1.3. Others

6.1.3.1. Silicones

6.1.3.2. Lanolin & derivatives

6.1.3.3. Esters

6.1.3.4. Natural wax

6.1.3.5. Fatty Alcohols

6.1.3.6. Fatty Acids

6.1.3.7. Triglycerides

6.1.3.8. Amino Acids and Polypeptides

6.1.3.9. Alkoxylates

6.1.3.10. Others

6.2. Forecast from 2017 to 2022

6.2.1. Polyols

6.2.1.1. Sorbitol

6.2.1.2. Glycerine

6.2.1.3. PEG

6.2.1.4. Propylene Glycol

6.2.1.5. Others

6.2.2. Hydrocarbons

6.2.2.1. White Oil / Paraffin Liquid

6.2.2.2. Petroleum Jellies

6.2.2.3. Microcrystalline wax

6.2.2.4. Squalane

6.2.3. Others

6.2.3.1. Silicones

6.2.3.2. Lanolin & derivatives

6.2.3.3. Esters

6.2.3.4. Natural wax

6.2.3.5. Fatty Alcohols

6.2.3.6. Fatty Acids

6.2.3.7. Triglycerides

6.2.3.8. Amino Acids and Polypeptides

6.2.3.9. Alkoxylates

6.2.3.10. Others

6.2.4. Key growth drivers

6.2.5. Key challenges

7. Asia Pacific (exc. China) market analysis for Emollients, Film formers, Moisturizer Chemicals used in Cosmetics

7.1. Current market analysis for the year 2016

7.1.1. Polyols

7.1.1.1. Sorbitol

7.1.1.2. Glycerine

7.1.1.3. PEG

7.1.1.4. Propylene Glycol

7.1.1.5. Others

7.1.2. Hydrocarbons

7.1.2.1. White Oil / Paraffin Liquid

7.1.2.2. Petroleum Jellies

7.1.2.3. Microcrystalline wax

7.1.2.4. Squalane

7.1.3. Others

7.1.3.1. Silicones

7.1.3.2. Lanolin & derivatives

7.1.3.3. Esters

7.1.3.4. Natural wax

7.1.3.5. Fatty Alcohols

7.1.3.6. Fatty Acids

7.1.3.7. Triglycerides

7.1.3.8. Amino Acids and Polypeptides

7.1.3.9. Alkoxylates

7.1.3.10. Others

7.2. Forecast from 2017 to 2022

7.2.1. Polyols

7.2.1.1. Sorbitol

7.2.1.2. Glycerine

7.2.1.3. PEG

7.2.1.4. Propylene Glycol

7.2.1.5. Others

7.2.2. Hydrocarbons

7.2.2.1. White Oil / Paraffin Liquid

7.2.2.2. Petroleum Jellies

7.2.2.3. Microcrystalline wax

7.2.2.4. Squalane

7.2.3. Others

7.2.3.1. Silicones

7.2.3.2. Lanolin & derivatives

7.2.3.3. Esters

7.2.3.4. Natural wax

7.2.3.5. Fatty Alcohols

7.2.3.6. Fatty Acids

7.2.3.7. Triglycerides

7.2.3.8. Amino Acids and Polypeptides

7.2.3.9. Alkoxylates

7.2.3.10. Others

7.2.4. Key growth drivers

7.2.5. Key challenges

8. Rest of the world market analysis for Emollients, Film formers, Moisturizer Chemicals used in Cosmetics

8.1. Current market analysis for the year 2016

8.1.1. Polyols

8.1.1.1. Sorbitol

8.1.1.2. Glycerine

8.1.1.3. PEG

8.1.1.4. Propylene Glycol

8.1.1.5. Others

8.1.2. Hydrocarbons

8.1.2.1. White Oil / Paraffin Liquid

8.1.2.2. Petroleum Jellies

8.1.2.3. Microcrystalline wax

8.1.2.4. Squalane

8.1.3. Others

8.1.3.1. Silicones

8.1.3.2. Lanolin & derivatives

8.1.3.3. Esters

8.1.3.4. Natural wax

8.1.3.5. Fatty Alcohols

8.1.3.6. Fatty Acids

8.1.3.7. Triglycerides

8.1.3.8. Amino Acids and Polypeptides

8.1.3.9. Alkoxylates

8.1.3.10. Others

8.2. Forecast from 2017 to 2022

8.2.1. Polyols

8.2.1.1. Sorbitol

8.2.1.2. Glycerine

8.2.1.3. PEG

8.2.1.4. Propylene Glycol

8.2.1.5. Others

8.2.2. Hydrocarbons

8.2.2.1. White Oil / Paraffin Liquid

8.2.2.2. Petroleum Jellies

8.2.2.3. Microcrystalline wax

8.2.2.4. Squalane

8.2.3. Others

8.2.3.1. Silicones

8.2.3.2. Lanolin & derivatives

8.2.3.3. Esters

8.2.3.4. Natural wax

8.2.3.5. Fatty Alcohols

8.2.3.6. Fatty Acids

8.2.3.7. Triglycerides

8.2.3.8. Amino Acids and Polypeptides

8.2.3.9. Alkoxylates

8.2.3.10. Others

8.2.4. Key growth drivers

8.2.5. Key challenges

9. Historical & forecast price analysis for the following regions

9.1. North America

9.2. Western Europe

9.3. Asia pacific excluding China

9.4. China

10. Analysis of key manufacturers of Emollients, Film formers, Moisturizer Chemicals used in Cosmetics *

10.1. Company 1

10.1.1. Company introduction

10.1.2. SWOT analysis in terms of Emollients, Film formers, Moisturizer Chemicals used in Cosmetics

10.1.3. Financials*

10.1.4. Employee and R&D details**

10.1.5. Products offerings

10.1.5.1. Emollients, Film formers, Moisturizer Chemicals used in Cosmetics

10.1.5.2. Other products

10.1.6. Plant locations

10.1.6.1. Details of Emollients, Film formers, Moisturizer Chemicals used in Cosmetics plant

10.1.7. Installed capacity of Emollients, Film formers, Moisturizer Chemicals used in Cosmetics

10.1.7.1. Capacity expansion plans

10.1.7.2. Capacity shares of Emollients, Film formers, Moisturizer Chemicals used in Cosmetics

10.1.8. Strategic imperatives

10.2. Same parameters as above will be repeated for the following companies across:

10.2.1. North America

10.2.1.1. Archer Daniels Midland Co.

10.2.1.2. Arizona Chemical Company

10.2.1.3. Cognis Corporation

10.2.1.4. Corn Products International

10.2.1.5. Croda

10.2.1.6. Elementis Specialties

10.2.1.7. Inolex Chemical Company

10.2.1.8. ISP

10.2.1.9. Lipo Chemicals

10.2.1.10. Lonza

10.2.1.11. LyondellBasell Industries

10.2.1.12. Momentive Performance Materials Inc.

10.2.1.13. RITA Corporation

10.2.1.14. Roquette America, Inc.

10.2.1.15. Sasol North America

10.2.1.16. Shin-Etsu Silicones of America

10.2.1.17. Stepan Company

10.2.1.18. The Procter & Gamble Company

10.2.1.19. Wacker Chemical Corporation

10.2.1.20. Vantage Chemicals

10.2.2. Western Europe

10.2.2.1. AarhusKarlshamn AB

10.2.2.2. Aiglon SA

10.2.2.3. Akzo Nobel

10.2.2.4. BASF

10.2.2.5. Cargill

10.2.2.6. Clariant

10.2.2.7. CLR Chemical Laboratorium

10.2.2.8. Cognis

10.2.2.9. Croda

10.2.2.10. Dow Chemical

10.2.2.11. DSM

10.2.2.12. Fuchs Lubricants

10.2.2.13. Gattefossé

10.2.2.14. Kelisema

10.2.2.15. Kolb

10.2.2.16. Lakeoil

10.2.2.17. Lanolines de la Tossee

10.2.2.18. Momentive Performance Materials

10.2.2.19. Oleon NV

10.2.2.20. Roquette Frères

10.2.2.21. Sasol Olefins & Surfactants GmbH

10.2.2.22. SEPPIC

10.2.2.23. Solvay SA

10.2.2.24. Sonneborn

10.2.2.25. Sophim

10.2.2.26. Stearinerie Dubois

10.2.2.27. Wacker Chemie

10.2.3. Asia Pacific

10.2.3.1. ADEKA Corporation

10.2.3.2. Asahi Glass Company

10.2.3.3. Basic Chemical Industry Limited

10.2.3.4. Bussan Fine Chemical Co., Ltd.

10.2.3.5. Chuo Kasei Company Limited

10.2.3.6. Cisadane Raya Chemical

10.2.3.7. Croda Japan

10.2.3.8. Daicel Chemical Industries

10.2.3.9. Domas Agrointi Prima

10.2.3.10. Ecogreen Oleochemicals

10.2.3.11. Emery Oleochemicals Sdn. Bhd. ,

10.2.3.12. Food Chemifa Co., Ltd.

10.2.3.13. Guangdong Guangzhou Litze

10.2.3.14. H.K. Finechem Limited

10.2.3.15. Jilin Petrochemical Company

10.2.3.16. Kaneda Limited

10.2.3.17. Kokyu Alcohol Kogyo Co., Ltd

10.2.3.18. Lion Corporation

10.2.3.19. Matsumura Oil Research Corporation

10.2.3.20. Mitsui Chemicals

10.2.3.21. Miyoshi Oil & Fat Co., Ltd.

10.2.3.22. New Japan Chemical Co., Ltd.

10.2.3.23. Nikko Chemicals Co., Ltd.

10.2.3.24. Nikko Rika Corporation

10.2.3.25. Nippon Fine Chemical Co., Ltd.

10.2.3.26. Nissan Chemical Industries, Ltd

10.2.3.27. NOF Corporation

10.2.3.28. Pan-Century Oleochemicals Sdn. Bhd.

10.2.3.29. Pilipinas Kao

10.2.3.30. Raj Agro Mills

10.2.3.31. Sakamoto Orient Chemicals Corporation

10.2.3.32. Shanghai Goodway Chemical

10.2.3.33. Shanghai Jing Di Chemical

10.2.3.34. Shanghai Jinshan Jingwei Chemical

10.2.3.35. Shinei Kagaku K.K.

10.2.3.36. Tianjin Henkel

10.2.3.37. Tianjin Tian Zhi Fine Chemical

10.2.3.38. VVF Limited

10.2.3.39. Wings Surya

11. Conclusion

SDMR employs a three way data triangulation approach to arrive at market estimates. We use primary research, secondary research and data triangulation by top down and bottom up approach

Secondary Research:

Our research methodology involves in-depth desk research using various secondary sources. Data is gathered from association/government publications/databases, company websites, press releases, annual reports/presentations/sec filings, technical papers, journals, research papers, magazines, conferences, tradeshows, and blogs.

Key Data Points through secondary research-

Macro-economic data points

Import Export data

Identification of major market trends across various applications

Primary understanding of the industry for both the regions

Competitors analysis for the production capacities, key production sites, competitive landscape

Key customers

Production Capacity

Pricing Scenario

Cost Margin Analysis

Key Data Points through primary research-

Major factors driving the market and its end application markets

Comparative analysis and customer analysis

Regional presence

Collaborations or tie-ups

Annual Production, and sales

Profit Margins

Average Selling Price

Data Triangulation:

Data triangulation is done using top down and bottom approaches. However, to develop accurate market sizing estimations, both the methodologies are used to accurately arrive at the market size. Insert Image