In vitro fertilization is an assisted reproductive technology (ART), which involves retrieving eggs from a womans ovaries and fertilizing them with sperm outside the body, in vitro.

Increase in cases of infertility and development of advanced technologies such as lens less imaging of the sperms are likely to drive the market in coming years.

In 2018, the global In-Vitro Fertilization (IVF) market size was xx million US$ and it is expected to reach xx million US$ by the end of 2025, with a CAGR of xx% during 2019-2025.

This report focuses on the global In-Vitro Fertilization (IVF) status, future forecast, growth opportunity, key market and key players. The study objectives are to present the In-Vitro Fertilization (IVF) development in United States, Europe and China.

The key players covered in this study

OvaScience

EMD Serono Inc.

Vitrolife AB

Irvine Scientific

Cook Medical Inc.

Cooper Surgical Inc.

Genea Biomedx

Thermo Fisher Scientific Inc.

Progyny Inc.

Boston IVF

Market segment by Type, the product can be split into

Culture Media

Disposable Devices

Capital Equipment

Market segment by Application, split into

Fertility Clinics

Hospitals

Surgical Centers

Clinical Research Institutes

Market segment by Regions/Countries, this report covers

United States

Europe

China

Japan

Southeast Asia

India

Central & South America

The study objectives of this report are:

To analyze global In-Vitro Fertilization (IVF) status, future forecast, growth opportunity, key market and key players.

To present the In-Vitro Fertilization (IVF) development in United States, Europe and China.

To strategically profile the key players and comprehensively analyze their development plan and strategies.

To define, describe and forecast the market by product type, market and key regions.

In this study, the years considered to estimate the market size of In-Vitro Fertilization (IVF) are as follows:

History Year: 2014-2018

Base Year: 2018

Estimated Year: 2019

Forecast Year 2019 to 2025

For the data information by region, company, type and application, 2018 is considered as the base year. Whenever data information was unavailable for the base year, the prior year has been considered.

Table of Contents

1 Report Overview

1.1 Study Scope

1.2 Key Market Segments

1.3 Players Covered

1.4 Market Analysis by Type

1.4.1 Global In-Vitro Fertilization (IVF) Market Size Growth Rate by Type (2014-2025)

1.4.2 Culture Media

1.4.3 Disposable Devices

1.4.4 Capital Equipment

1.5 Market by Application

1.5.1 Global In-Vitro Fertilization (IVF) Market Share by Application (2014-2025)

1.5.2 Fertility Clinics

1.5.3 Hospitals

1.5.4 Surgical Centers

1.5.5 Clinical Research Institutes

1.6 Study Objectives

1.7 Years Considered

2 Global Growth Trends

2.1 In-Vitro Fertilization (IVF) Market Size

2.2 In-Vitro Fertilization (IVF) Growth Trends by Regions

2.2.1 In-Vitro Fertilization (IVF) Market Size by Regions (2014-2025)

2.2.2 In-Vitro Fertilization (IVF) Market Share by Regions (2014-2019)

2.3 Industry Trends

2.3.1 Market Top Trends

2.3.2 Market Drivers

2.3.3 Market Opportunities

3 Market Share by Key Players

3.1 In-Vitro Fertilization (IVF) Market Size by Manufacturers

3.1.1 Global In-Vitro Fertilization (IVF) Revenue by Manufacturers (2014-2019)

3.1.2 Global In-Vitro Fertilization (IVF) Revenue Market Share by Manufacturers (2014-2019)

3.1.3 Global In-Vitro Fertilization (IVF) Market Concentration Ratio (CR5 and HHI)

3.2 In-Vitro Fertilization (IVF) Key Players Head office and Area Served

3.3 Key Players In-Vitro Fertilization (IVF) Product/Solution/Service

3.4 Date of Enter into In-Vitro Fertilization (IVF) Market

3.5 Mergers & Acquisitions, Expansion Plans

4 Breakdown Data by Type and Application

4.1 Global In-Vitro Fertilization (IVF) Market Size by Type (2014-2019)

4.2 Global In-Vitro Fertilization (IVF) Market Size by Application (2014-2019)

5 United States

5.1 United States In-Vitro Fertilization (IVF) Market Size (2014-2019)

5.2 In-Vitro Fertilization (IVF) Key Players in United States

5.3 United States In-Vitro Fertilization (IVF) Market Size by Type

5.4 United States In-Vitro Fertilization (IVF) Market Size by Application

6 Europe

6.1 Europe In-Vitro Fertilization (IVF) Market Size (2014-2019)

6.2 In-Vitro Fertilization (IVF) Key Players in Europe

6.3 Europe In-Vitro Fertilization (IVF) Market Size by Type

6.4 Europe In-Vitro Fertilization (IVF) Market Size by Application

7 China

7.1 China In-Vitro Fertilization (IVF) Market Size (2014-2019)

7.2 In-Vitro Fertilization (IVF) Key Players in China

7.3 China In-Vitro Fertilization (IVF) Market Size by Type

7.4 China In-Vitro Fertilization (IVF) Market Size by Application

8 Japan

8.1 Japan In-Vitro Fertilization (IVF) Market Size (2014-2019)

8.2 In-Vitro Fertilization (IVF) Key Players in Japan

8.3 Japan In-Vitro Fertilization (IVF) Market Size by Type

8.4 Japan In-Vitro Fertilization (IVF) Market Size by Application

9 Southeast Asia

9.1 Southeast Asia In-Vitro Fertilization (IVF) Market Size (2014-2019)

9.2 In-Vitro Fertilization (IVF) Key Players in Southeast Asia

9.3 Southeast Asia In-Vitro Fertilization (IVF) Market Size by Type

9.4 Southeast Asia In-Vitro Fertilization (IVF) Market Size by Application

10 India

10.1 India In-Vitro Fertilization (IVF) Market Size (2014-2019)

10.2 In-Vitro Fertilization (IVF) Key Players in India

10.3 India In-Vitro Fertilization (IVF) Market Size by Type

10.4 India In-Vitro Fertilization (IVF) Market Size by Application

11 Central & South America

11.1 Central & South America In-Vitro Fertilization (IVF) Market Size (2014-2019)

11.2 In-Vitro Fertilization (IVF) Key Players in Central & South America

11.3 Central & South America In-Vitro Fertilization (IVF) Market Size by Type

11.4 Central & South America In-Vitro Fertilization (IVF) Market Size by Application

12 International Players Profiles

12.1 OvaScience

12.1.1 OvaScience Company Details

12.1.2 Company Description and Business Overview

12.1.3 In-Vitro Fertilization (IVF) Introduction

12.1.4 OvaScience Revenue in In-Vitro Fertilization (IVF) Business (2014-2019)

12.1.5 OvaScience Recent Development

12.2 EMD Serono Inc.

12.2.1 EMD Serono Inc. Company Details

12.2.2 Company Description and Business Overview

12.2.3 In-Vitro Fertilization (IVF) Introduction

12.2.4 EMD Serono Inc. Revenue in In-Vitro Fertilization (IVF) Business (2014-2019)

12.2.5 EMD Serono Inc. Recent Development

12.3 Vitrolife AB

12.3.1 Vitrolife AB Company Details

12.3.2 Company Description and Business Overview

12.3.3 In-Vitro Fertilization (IVF) Introduction

12.3.4 Vitrolife AB Revenue in In-Vitro Fertilization (IVF) Business (2014-2019)

12.3.5 Vitrolife AB Recent Development

12.4 Irvine Scientific

12.4.1 Irvine Scientific Company Details

12.4.2 Company Description and Business Overview

12.4.3 In-Vitro Fertilization (IVF) Introduction

12.4.4 Irvine Scientific Revenue in In-Vitro Fertilization (IVF) Business (2014-2019)

12.4.5 Irvine Scientific Recent Development

12.5 Cook Medical Inc.

12.5.1 Cook Medical Inc. Company Details

12.5.2 Company Description and Business Overview

12.5.3 In-Vitro Fertilization (IVF) Introduction

12.5.4 Cook Medical Inc. Revenue in In-Vitro Fertilization (IVF) Business (2014-2019)

12.5.5 Cook Medical Inc. Recent Development

12.6 Cooper Surgical Inc.

12.6.1 Cooper Surgical Inc. Company Details

12.6.2 Company Description and Business Overview

12.6.3 In-Vitro Fertilization (IVF) Introduction

12.6.4 Cooper Surgical Inc. Revenue in In-Vitro Fertilization (IVF) Business (2014-2019)

12.6.5 Cooper Surgical Inc. Recent Development

12.7 Genea Biomedx

12.7.1 Genea Biomedx Company Details

12.7.2 Company Description and Business Overview

12.7.3 In-Vitro Fertilization (IVF) Introduction

12.7.4 Genea Biomedx Revenue in In-Vitro Fertilization (IVF) Business (2014-2019)

12.7.5 Genea Biomedx Recent Development

12.8 Thermo Fisher Scientific Inc.

12.8.1 Thermo Fisher Scientific Inc. Company Details

12.8.2 Company Description and Business Overview

12.8.3 In-Vitro Fertilization (IVF) Introduction

12.8.4 Thermo Fisher Scientific Inc. Revenue in In-Vitro Fertilization (IVF) Business (2014-2019)

12.8.5 Thermo Fisher Scientific Inc. Recent Development

12.9 Progyny Inc.

12.9.1 Progyny Inc. Company Details

12.9.2 Company Description and Business Overview

12.9.3 In-Vitro Fertilization (IVF) Introduction

12.9.4 Progyny Inc. Revenue in In-Vitro Fertilization (IVF) Business (2014-2019)

12.9.5 Progyny Inc. Recent Development

12.10 Boston IVF

12.10.1 Boston IVF Company Details

12.10.2 Company Description and Business Overview

12.10.3 In-Vitro Fertilization (IVF) Introduction

12.10.4 Boston IVF Revenue in In-Vitro Fertilization (IVF) Business (2014-2019)

12.10.5 Boston IVF Recent Development

13 Market Forecast 2019-2025

13.1 Market Size Forecast by Regions

13.2 United States

13.3 Europe

13.4 China

13.5 Japan

13.6 Southeast Asia

13.7 India

13.8 Central & South America

13.9 Market Size Forecast by Product (2019-2025)

13.10 Market Size Forecast by Application (2019-2025)

14 Analyst's Viewpoints/Conclusions

15 Appendix

15.1 Research Methodology

15.1.1 Methodology/Research Approach

15.1.1.1 Research Programs/Design

15.1.1.2 Market Size Estimation

12.1.1.3 Market Breakdown and Data Triangulation

15.1.2 Data Source

15.1.2.1 Secondary Sources

15.1.2.2 Primary Sources

15.2 Disclaimer

15.3 Author Details

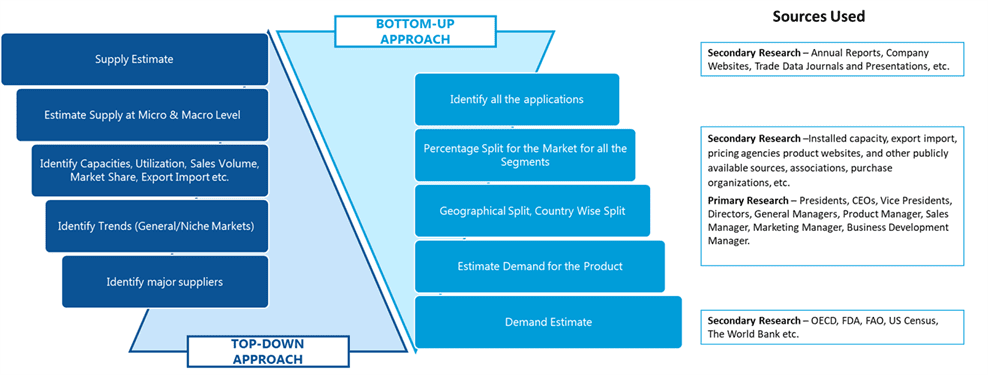

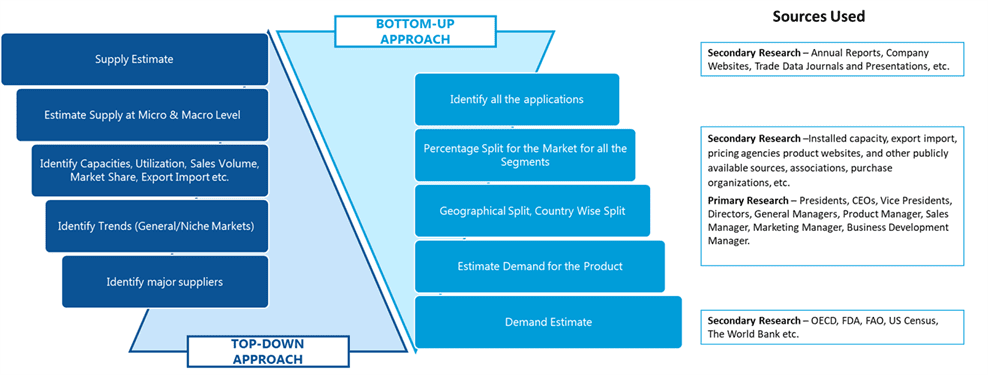

SDMR employs a three way data triangulation approach to arrive at market estimates. We use primary research, secondary research and data triangulation by top down and bottom up approach

Secondary Research:

Our research methodology involves in-depth desk research using various secondary sources. Data is gathered from association/government publications/databases, company websites, press releases, annual reports/presentations/sec filings, technical papers, journals, research papers, magazines, conferences, tradeshows, and blogs.

Key Data Points through secondary research-

Macro-economic data points

Import Export data

Identification of major market trends across various applications

Primary understanding of the industry for both the regions

Competitors analysis for the production capacities, key production sites, competitive landscape

Key customers

Production Capacity

Pricing Scenario

Cost Margin Analysis

Key Data Points through primary research-

Major factors driving the market and its end application markets

Comparative analysis and customer analysis

Regional presence

Collaborations or tie-ups

Annual Production, and sales

Profit Margins

Average Selling Price

Data Triangulation:

Data triangulation is done using top down and bottom approaches. However, to develop accurate market sizing estimations, both the methodologies are used to accurately arrive at the market size. Insert Image