Industry Insights

The global shea butter market size was valued at USD 1.12 billion in 2018. Shea Butter is a skin superfood that comes from the seeds of the fruit of the Shea (Karite) tree. It may offer mild UV protection and provides the skin with essential fatty acids and the nutrients necessary for collagen production. Increasing demand for coco butter alternative and growing consumption of chocolate and bakery products are expected to drive the market. Easy availability of cheaper substitute products including shea oil, mango butter, and avocado butter is likely to restrain the industry growth.

The global Shea Butter market is segmented on the basis of Type, and Applications. The global Shea Butter market Based on Type the global Shea Butter market is segregated as Raw and Unrefined Shea Butter, and Refined Shea Butter. Based on Applications the global Shea Butter market is segmented as Food & Beverage, Personal Care & Cosmetics , and Pharmaceutical.

The regional outlook on the global Shea Butter Market covers regions, such as North America, Europe, Asia-Pacific, and Rest of the World. The Shea Butter market for each region is further bifurcated for major countries including the U.S., Canada, Germany, the U.K., France, Italy, China, India, Japan, Brazil, South Africa, and others.

Competitive Landscape

The global Shea Butter market is highly competitive in nature with major players including BASF SE, Olvea Group; Sophim S.A., Cargill, Inc., Suru Chemicals , Ghana Nuts Company Ltd. , Croda International Plc, Agrobotanicals, LLC , Clariant AG, AAK AB., and others. The report covers competitive analysis on the key market share holders. The companies are focused on several expansion and growth strategies to enhance their footprint in the Shea Butter market. Market players are also involved in value chain integration gain competitive advantage.

Report Scope:

The Shea Butter market report scope covers the in-depth business analysis considering major market dynamics, forecast parameters, and price trends for the industry growth. The report forecasts market sizing at global, regional and country levels, providing comprehensive outlook of industry trends in each market segments and sub-segments from 2017 to 2024. The market segmentations include,

Shea Butter Market, By Type

• Raw and Unrefined Shea Butter,

• Refined Shea Butter

Shea Butter Market, By Applications

• Food & Beverage

• Personal Care & Cosmetics

• Pharmaceutical

Shea Butter Market, By Region

• North America

• Europe

• Asia-Pacific

• Rest of the World

The report scope also includes competitive landscape covering the competitive analysis, strategy analysis and company profiles of the major market players. The companies profiled in the report include BASF SE, Olvea Group; Sophim S.A., Cargill, Inc., Suru Chemicals , Ghana Nuts Company Ltd. , Croda International Plc, Agrobotanicals, LLC , Clariant AG, AAK AB., and others. Company profiles cover company overview, product landscape, financial overview, and strategy analysis.

Report Highlights

• Global Shea Butter market sizes from 2017 to 2024

• Market growth projections through 2024 and the resultant market forecast for 2024

• Impact of the market dynamics including market drivers, restraints and opportunities in the market size

• Key industry trends, product trends, and application trends

• Major driving/ leading segmentations, regions and countries in the global Shea Butter market

• Competitive analysis with comprehensive company profiles of the leading industry players

• In-depth analysis on growth and expansion strategies adopted by market players and their resulting effect on market growth and competition

Report Customizations

The customization research services cover the additional custom report features such as additional regional and country level analysis as per the client requirements.

Table of Contents

1. Introduction

1.1 Key Insights

1.2 Report Overview

1.3 Markets Covered

1.4 Stakeholders

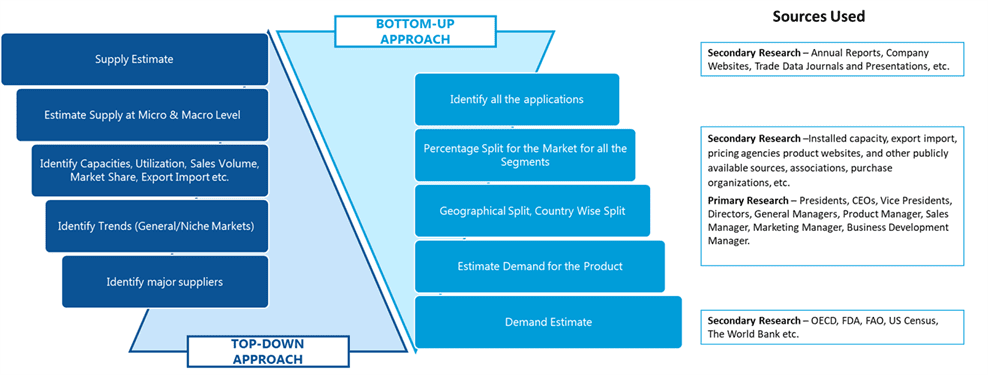

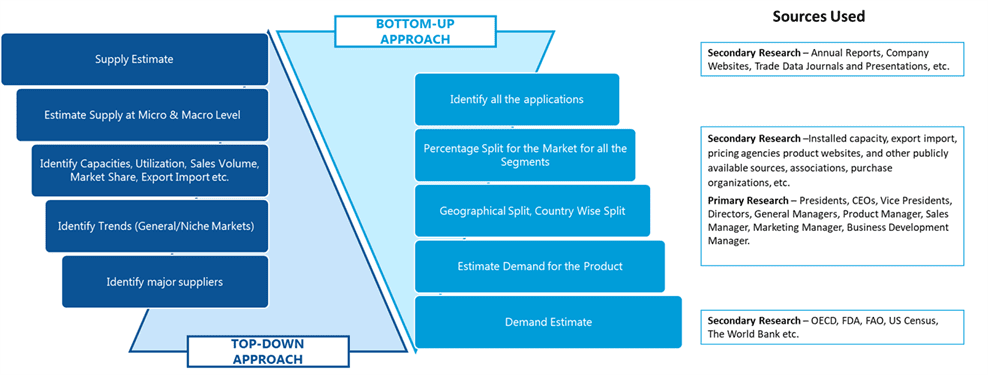

2. Research Methodology

2.1 Research Scope

2.2 Market Research Process

2.3 Research Data Analysis

2.4.1 Secondary Research

2.4.2 Primary Research

2.4.3 Models for Estimation

2.5 Market Size Estimation

2.5.1 Bottom-Up Approach - Segmental Market Analysis

2.5.2 Top-Down Approach - Parent Market Analysis

3. Executive Summary

4. Market Overview

4.1 Introduction

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.2.4 Challenges

4.2 Porter's Five Force Analysis

5. Shea Butter Market, By Type

5.1 Introduction

5.2 Raw and Unrefined Shea Butter,

5.2.1 Market Overview

5.2.2 Market Size and Forecast

5.3 Refined Shea Butter

5.3.1 Market Overview

5.3.2 Market Size and Forecast

6. Shea Butter Market, By Applications

6.1 Introduction

6.2 Food & Beverage

6.2.1 Market Overview

6.2.2 Market Size and Forecast

6.3 Personal Care & Cosmetics

6.3.1 Market Overview

6.3.2 Market Size and Forecast

6.4 Pharmaceutical

6.4.1 Market Overview

6.4.2 Market Size and Forecast

7. Shea Butter Market, By Geography

7.1 Introduction

7.2 North America

7.2.1 North America Shea Butter , By Type

7.2.2 North America Shea Butter , By Applications

7.3 Europe

7.3.1 Europe Shea Butter , By Type

7.3.2 Europe Shea Butter , By Applications

7.4 Asia-Pacific

7.4.1 Asia-Pacific Shea Butter , By Type

7.4.2 Asia-Pacific Shea Butter , By Applications

7.5 Rest of the World

7.5.1 Rest of the World Shea Butter , By Type

7.5.2 Rest of the World Shea Butter , By Applications

8. Competitive Insights

8.1 Key Insights

8.2 Company Market Share Analysis

8.3 Strategic Outlook

8.3.1 Mergers & Acquisitions

8.3.2 New Product Development

8.3.3 Portfolio/Production Capacity Expansions

8.3.4 Joint Ventures, Collaborations, Partnerships & Agreements

8.3.5 Others

9. Company Profiles

9.1 BASF SE

9.1.1 Company Overview

9.1.2 Product/Service Landscape

9.1.3 Financial Overview

9.1.4 Recent Developments

9.2 Olvea Group; Sophim S.A.

9.2.1 Company Overview

9.2.2 Product/Service Landscape

9.2.3 Financial Overview

9.2.4 Recent Developments

9.3 Cargill, Inc.

9.3.1 Company Overview

9.3.2 Product/Service Landscape

9.3.3 Financial Overview

9.3.4 Recent Developments

9.4 Suru Chemicals

9.4.1 Company Overview

9.4.2 Product/Service Landscape

9.4.3 Financial Overview

9.4.4 Recent Developments

9.5 Ghana Nuts Company Ltd.

9.5.1 Company Overview

9.5.2 Product/Service Landscape

9.5.3 Financial Overview

9.5.4 Recent Developments

9.6 Croda International Plc

9.6.1 Company Overview

9.6.2 Product/Service Landscape

9.6.3 Financial Overview

9.6.4 Recent Developments

9.7 Agrobotanicals, LLC

9.7.1 Company Overview

9.7.2 Product/Service Landscape

9.7.3 Financial Overview

9.7.4 Recent Developments

9.8 Clariant AG

9.8.1 Company Overview

9.8.2 Product/Service Landscape

9.8.3 Financial Overview

9.8.4 Recent Developments

9.9 AAK AB.

9.9.1 Company Overview

9.9.2 Product/Service Landscape

9.9.3 Financial Overview

9.9.4 Recent Developments

SDMR employs a three way data triangulation approach to arrive at market estimates. We use primary research, secondary research and data triangulation by top down and bottom up approach

Secondary Research:

Our research methodology involves in-depth desk research using various secondary sources. Data is gathered from association/government publications/databases, company websites, press releases, annual reports/presentations/sec filings, technical papers, journals, research papers, magazines, conferences, tradeshows, and blogs.

Key Data Points through secondary research-

Macro-economic data points

Import Export data

Identification of major market trends across various applications

Primary understanding of the industry for both the regions

Competitors analysis for the production capacities, key production sites, competitive landscape

Key customers

Production Capacity

Pricing Scenario

Cost Margin Analysis

Key Data Points through primary research-

Major factors driving the market and its end application markets

Comparative analysis and customer analysis

Regional presence

Collaborations or tie-ups

Annual Production, and sales

Profit Margins

Average Selling Price

Data Triangulation:

Data triangulation is done using top down and bottom approaches. However, to develop accurate market sizing estimations, both the methodologies are used to accurately arrive at the market size. Insert Image